December 2022 Portfolio Management Team Update

December 2022 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM®, Portfolio Manager, iA Private Wealth

December 20, 2022

Market Review

Global equities continued the rally from their October lows through November, on optimism that a potential peaking of inflationary pressures could bring the relentless hike in interest rates by major central banks to a halt early next year.

The TSX Composite gained 5.3% for the second successive month in November, bringing the rebound from its 2022 low reached on October 12 to 14.5%. Last month’s advance on the TSX was led by the mining and technology sectors, with participation from the financials, industrials, and consumer groups as well.

The S&P 500 gained 5.4% last month, adding to its 8.0% rebound in October, while the Nasdaq Composite rose 4.4%. The Dow Jones Industrial Average gained 5.7%, after a 14.0% surge in October that was its best monthly performance since 1976. Major indices in Europe and Asia also continued to rally last month from their October lows. (Data Source: FactSet).

Our Strategy

Investor complacency about an imminent end to central banks’ rate hikes was shattered by the Federal Reserve’s statement on December 14. While the Federal Reserve raised its benchmark rate as expected by 50 basis points to a targeted range of 4.25% – 4.50%, the highest level in 15 years, it also said that ongoing rate increases would be appropriate to make monetary policy sufficiently restrictive to return inflation to 2% over time. The expected “terminal rate” – the point at which Federal Reserve members expect to end rate hikes – was forecast at 5.1%, according to the Fed’s “dot plot,” suggesting that rate increases would continue well into 2023.

The Bank of Canada had also raised its benchmark rate a week earlier by 50 basis points to 4.25% but sounded less hawkish in its rate announcement, saying that it will consider whether interest rates need to rise further to bring supply and demand back into balance, and return inflation to its 2% target.

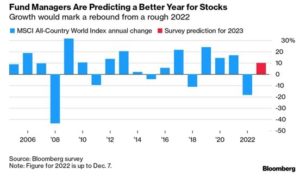

Investor sentiment has yet again been impacted by fears that the global economy could be tipped into recession in 2023, with U.S. indices and the TSX sliding between 5% and 8% so far this month. But with the S&P 500 and Nasdaq Composite down almost 20% and 33% YTD, we believe equity prices already reflect most of the downside from an economic slowdown. A global Bloomberg survey of fund managers echoes this sentiment, with the average expectation for a return of 10% in the MSCI All-Country World Index in 2023 (see Figure).

The Portfolio Management Team (PMT) had made substantial changes to client portfolios in November, following its biannual asset allocation review. These changes, which resulted in increasing the defensive tilt to portfolios by lowering the PMT’s target equity allocation and boosting fixed income, are working out well. The PMT believes that these changes position client portfolios well going into 2023, with the quality improvement enabling portfolios to withstand renewed market turbulence while participating fully in an eventual recovery.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

October 2024 Portfolio Management Team Update

October 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth October 3, 2024 Market Review Global equities advanced to new highs last month to cap a volatile quarter, as interest rate cuts by major central banks boosted optimism for a soft landing despite mixed economic data. The TSX […]

Read more

September 2024 Portfolio Management Team Update

September 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth September 24, 2024 Market Review Global equities added to gains in August, as they recovered from the worst bout of volatility since 2022 that erupted in the first week of the month. The TSX advanced 1.0% last […]

Read more

August 2024 Portfolio Management Team Update

August 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth August 13, 2024 Market Review Global equities surged to new highs in July as inflation concerns abated, before the worst bout of volatility since 2022 erupted in the first week of August, taking the S&P 500 to the […]

Read more