January 2023 Portfolio Management Team Update

January 2023 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM®, Portfolio Manager, iA Private Wealth

January 26, 2023

Market Review

Global equities finished 2022 on a dismal note, capping an exceptionally challenging year as central banks around the world boosted interest rates sharply to combat the threat posed by surging inflation. The spike in interest rates and bond yields took its toll on most asset classes, including equities, fixed income, and real estate; energy and agricultural commodities were among the few gainers in the year.

In Canada, the TSX fell 5.2% in December, after gaining 5.3% in each of the preceding two months, for a fourth-quarter gain of 5.1%. Overall, the index declined 8.7% in 2022, its first down year since 2018. Energy (+24.4%) and consumer staples (+8.5%) were the only two sectors to finish in positive territory for the year, while decliners were led by health care (-62.2%) and technology (-52.2%). Shopify Inc was among the worst performers on the TSX in 2022, plunging 73% over the year after having soared more than nine-fold cumulatively in the previous three years.

U.S. equity indices registered their worst annual performance since 2008 last year. The S&P 500 tumbled 5.9% in December to finish Q4 with a gain of 7.1%, for an overall decline of 19.4% in the year. The Dow Jones Industrial Average fared much better on a comparative basis, as losses in its technology components were offset by gains in its health care constituents. Despite a 4.2% decline in December, the index posted a 15.4% gain in Q4 – thanks to a 14.0% surge in October that was its best monthly performance since 1976 – and a loss of 8.8% for the year.

The Nasdaq Composite endured one of its worst Decembers on record with an 8.7% plunge that erased earlier gains in the quarter and resulted in a Q4 loss of 1.0%. The technology bellwether plummeted 33.1% in 2022, as several of the largest companies including Tesla, Meta, Nvidia and Amazon lost at least half of their market capitalization.

Most major indices in Europe and Asia also posted double-digit declines in 2022, although the UK’s FTSE index bucked the trend with a gain of 0.9% for the year. Among the major emerging markets, Brazil’s Bovespa rose 4.7% and India’s Sensex gained 4.4%, while China’s Shanghai Composite fell 15.1%.

The fixed income market also had a rough year, with the S&P Canada Aggregate Bond Index down 13.0% and its U.S. counterpart losing 14.4% for the year. Speculative assets crashed, with cryptocurrencies losing more than $2 trillion from their November 2021 peak as Bitcoin plunged 63% and a number of crypto trading platforms declared bankruptcy.

(Data Source: FactSet).

Our Strategy

Market turmoil in 2022 was exacerbated by the Russian invasion of Ukraine in February 2022 – the second “wildcard” event in two years, the pandemic being the first – as it intensified inflationary pressures by causing price spikes in energy and commodities. With inflation already stirring as the global economy emerged from its pandemic-induced slumber, central banks around the world embarked on their most concerted round of interest rate hikes in decades. But those relentless rate increases could well come to an end in 2023, as inflation cools and economic growth slows down.

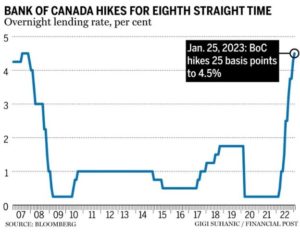

On January 25, 2023, the Bank of Canada (BoC) boosted its overnight lending rate for the eighth successive time, with the increase of 25 basis points taking that rate to a 15-year high of 4.5% (see Figure). The BoC said that if economic developments evolve in line with its outlook, it expects to hold the policy interest rate at its current level while it assesses the impact of cumulative rate increases.

The Bank expects economic growth to stall through mid-2023 but pick up later in the year, for overall GDP growth of about 1% in 2023 and 2% in 2024. It also projects inflation to come down significantly this year, as lower energy prices, improvements in global supply, and effects of higher interest rates on demand are expected to bring CPI inflation down to around 3% by mid-year and back to its 2% target in 2024.

While such a “soft landing” scenario would be bullish for equities and risk assets, it remains to be seen whether this actually comes to pass, given that the Canadian and global economies continue to face some risks. That said, at the present time, investors seem to be increasingly optimistic that a deep recession in North America may yet be averted.

All eyes now turn to the Federal Reserve’s upcoming meeting at the end of January. According to a recent Reuters poll, most economists expect the Fed to raise the federal funds rate – currently at a targeted range of 4.25%- 4.50% – by 25 basis points at each of its next two policy meetings and then hold rates steady for the rest of the year.

Market performance in the first four weeks of 2023 should encourage investors who believe the adage that “as goes January, so goes the year.” As of January 26, the TSX Composite had gained 6.8%, with the S&P 500 and Nasdaq Composite up 5.8% and 10.0% respectively; European equities and emerging markets are also up substantially. Bonds have rallied, as 10-year government bond yields in the U.S. and Canada have retreated by 25 and 31 basis points respectively.

As investors’ attention again turns to corporate earnings and stock fundamentals, we believe our client portfolios will benefit from our consistent focus on quality. Our individual stock picks are typically blue chips that offer a compelling combination of growth prospects, dividend yield and reasonable valuations; on the fixed income and alternative side, we rely on the best fund managers in these areas.

The Portfolio Management Team (PMT) had made substantial changes to client portfolios in 2022 to counter rapidly changing market conditions. With these changes working out well so far, the PMT is confident that client portfolios remain well positioned to withstand downside risk while participating fully in an eventual recovery.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

October 2024 Portfolio Management Team Update

October 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth October 3, 2024 Market Review Global equities advanced to new highs last month to cap a volatile quarter, as interest rate cuts by major central banks boosted optimism for a soft landing despite mixed economic data. The TSX […]

Read more

September 2024 Portfolio Management Team Update

September 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth September 24, 2024 Market Review Global equities added to gains in August, as they recovered from the worst bout of volatility since 2022 that erupted in the first week of the month. The TSX advanced 1.0% last […]

Read more

August 2024 Portfolio Management Team Update

August 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth August 13, 2024 Market Review Global equities surged to new highs in July as inflation concerns abated, before the worst bout of volatility since 2022 erupted in the first week of August, taking the S&P 500 to the […]

Read more