May 2024 Portfolio Management Team Update

May 2024 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth

May 17, 2024

Market Review

Global equities fell in April after five straight months of gains, as concerns about sticky inflation and receding optimism about interest rate cuts by the Federal Reserve sapped investor sentiment. However, markets have rebounded strongly so far in May (as of May 17) to erase the previous month’s losses and go on to new highs. The TSX Composite and S&P 500 reached new records this month, while the Dow Jones Industrial Average (DJIA) exceeded 40,000 for the first time.

The TSX Composite fell 2.0% in April, as declines in most sectors – led by industrials, technology, health care, and financials – more than offset gains in metal producers that drove the materials group higher, as well as a marginal advance in the energy sector.

In the U.S., the S&P 500 retreated 4.2% in April after two straight quarters of double-digit gains, while the DJIA declined 5.0% and the Nasdaq Composite fell 4.4%. Large-cap U.S. stocks continued to outperform small-caps, with the Russell 1000 down 4.3%, compared with a 7.1% plunge in the Russell 2000.

The MSCI AC World Index pulled back 2.9% last month after two second consecutive quarterly gains of over 9%. Japan’s Nikkei 225, the best performer among major markets in Q1 with a 20.6% surge, retreated 4.9%, while Hong Kong’s Hang Seng index rebounded 7.4% after being one of the few decliners in Q1. The Euro Stoxx 50 index fell 3.2% in April as most European bourses pared solid Q1 gains.

(Sources: FactSet, Bloomberg)

Outlook & Portfolio Strategy

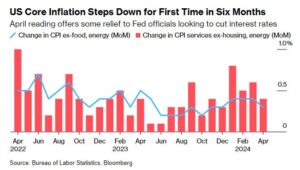

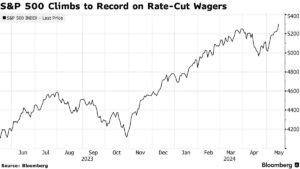

On May 15, economic data that showed the U.S. consumer price index cooled for the first time in six months (Figure 1) reinforced market wagers that the Federal Reserve will cut interest rates as early as September, propelling the S&P 500 to its 23rd record for the year (Figure 2).

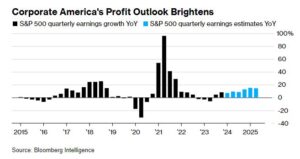

The market rally that commenced in early November is underpinned by strong fundamentals, with analysts raising earnings forecast for the current quarter at the fastest pace in two years. According to a FactSet analysis, based on the 80% of S&P 500 companies that had reported Q1 earnings as of May 3, the percentage of companies reporting positive earnings surprises and the magnitude of earnings surprises were both above their 10-year averages. Q1 earnings growth for the S&P 500 is on track to grow 5%, the highest year-over-year earnings growth reported by the index since Q2 2022 (Figure 3).

Overall, earnings per share (EPS) for the S&P 500 is forecast to rise from $214 in 2022 to about $277 in 2025, for a compound annual growth rate (CAGR) of 9.0% over this three-year period. For the TSX Composite, EPS is forecast to grow at a slower pace, from $1,553 in 2022 to $1,659 in 2025, a CAGR of 2.2%.

With corporate earnings growth in the U.S. far outpacing that in Canada, it’s no surprise that the S&P 500 has trounced the TSX Composite over the past decade (Figure 4). The S&P 500’s annual returns of 15.6% are double the 7.6% return from the TSX over this period.

The Portfolio Management Team (PMT) recently completed an in-depth review of its model portfolios. Given the continued outperformance of U.S. equities, the PMT intends to continue ratcheting up its U.S. exposure through diversified exchange traded funds (ETFs), as picking individual stocks has become increasingly challenging in the current environment. The PMT expects to implement these model changes in June and is confident that the outcome will be better risk-adjusted returns for client portfolios.

Figure 1: US core inflation heads lower

Figure 2: S&P 500 hits 23rd record in 2024

Figure 3: Earnings growth estimates for the S&P 500 are rising

Figure 4: S&P 500 annual returns are 2x TSX over the past decade

Source: FactSet

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

March 2025 Portfolio Management Team Update

March 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth March 25, 2025 SUMMARY Market Review: North American indices fell in February on mounting concerns about the impact of a global trade war. The selloff intensified into March, triggering a 10% correction in the S&P500 that wiped out […]

Read more

February 2025 Portfolio Management Team Update

February 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth February 25, 2025 SUMMARY Market Review: Global equities began the year positively with solid returns in January, but volatility in recent weeks underscores the risks that lie ahead. The TSX rose 3.3% last month, trading at a record […]

Read more

2024 IAPW Tax Document Distribution Dates

2024 IAPW Tax Document Distribution Dates There are different mailing dates for different account types. Please click on the link below to view the expected delivery for both mail and online tax slips and reports. 2024 Important Year-End Information – Tax Document Distribution Dates

Read more