February 2025 Portfolio Management Team Update

February 2025 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth

February 25, 2025

SUMMARY

Market Review: Global equities began the year positively with solid returns in January, but volatility in recent weeks underscores the risks that lie ahead. The TSX rose 3.3% last month, trading at a record high on January 30, while the S&P 500 gained 2.7%. A broad index of European stocks reached a record high, while Asian indices were mixed, with declines in China, India and Japan. Overall, equity markets were resilient enough to recover from two shocks in the space of a week, the DeepSeek-inspired technology rout of January 27, and the “tariff tantrum” of February 3.

Outlook: With the “Magnificent Seven” now in correction territory, down 10% from its record high reached in December, Nvidia’s earnings report is a make-or-break one for the AI theme that was the biggest driver of the S&P 500’s 53% surge in the last two years. The “risk off” mood in markets is intensifying as Trump’s tariff plans move ahead. The proposed tariffs could have a severe impact on Canada, triggering steep job losses and a 6% decline in GDP. Elevated uncertainty is weighing on the U.S. consumer as well, with confidence tumbling by the most since August 2021.

Amid these dark clouds, there are some silver linings, such as – the possibility that tariffs will not be fully implemented and U.S. threats to do so are a bargaining tactic; new-found Canadian resolve to deal with long-standing issues; reduced geopolitical risk through peace initiatives in the Middle East and Russia-Ukraine; and broad market participation in the U.S. that is offsetting the Mag 7’s decline.

Rebalances and Risk Mitigation: The PMT rebalanced portfolios in January, making significant changes to the fixed income sleeve of client portfolios. It continues to actively manage the Platinum Growth Fund to ensure superior performance. The PMT remains vigilant for opportunities created by market volatility, which is expected to increase in the months ahead.

Market Review

Global equities advanced in January to begin the year on a positive note, before a bout of volatility in the last week of the month underscored the risks that lie ahead.

The TSX gained 3.3% in the month, trading at a record high of 25,875 on January 30, as it rebounded from a 3.6% decline in December that was its worst monthly performance last year. The index’s best performers were the materials sector – led by metals and mining companies – and the technology group, both of which surged 10%. In the U.S., the S&P 500 advanced 2.7% in January, while the Dow Jones industrial Average rose 4.7% and the Nasdaq Composite was up 1.6%.

In international markets, Europe had an outstanding month as a broad index of European stocks reached a record high (in euro terms). The Euro Stoxx 50 index gained 8%, with major indices such as those of the U.K., France, Germany and Italy surging at least 6%. Asian indices were mixed, with China’s Shanghai Composite slumping 3% and Japan and India down 0.8%. The MSCI AC World Index gained 3.2% in January.

(Sources: FactSet, Bloomberg)

Outlook & Portfolio Strategy

Equity markets have been quite resilient in the face of mounting risks, recovering rapidly from two shocks that rocked markets towards the end of January. However, stocks are finding it increasingly difficult to scale the proverbial “Wall of Worry,” raising the odds of a significant correction sometime this year.

On January 27, news that a Chinese startup named DeepSeek had developed a low-cost artificial intelligence (“AI”) model at a fraction of the price of competing AI platforms triggered a $1 trillion rout on the Nasdaq Composite, led by a 17% plunge in Nvidia that erased a record $589 billion in its market value. But investors’ concerns that demand for AI infrastructure led by Nvidia’s chips would slump were assuaged by the biggest players in AI – including Amazon, Alphabet, Meta Platforms and Microsoft – indicating in their recent earnings calls that they would be spending a combined $325 billion in capital expenditures for 2025.

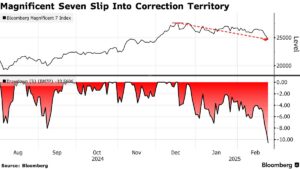

Although Nvidia had recovered from its plunge by February 18, when the S&P 500 reached a new record high, the stock has since come under renewed selling pressure. This makes Nvidia’s earnings report scheduled for February 26 a make-or-break one for the AI theme that has been the biggest driver of U.S. market performance for more than two years. With six of the “Magnificent Seven” in negative territory for the year, led by Tesla’s 25% plunge, the group is officially in correction territory with an overall decline of 10% from its record high reached on December 17 (Figure 1).

Figure 1: Magnificent 7 enter correction with overall decline of 10%

The “risk off” mood in markets is intensifying as President Trump’s tariff plans continue to move ahead. Trump clarified this week that the 25% levy on Canadian and Mexican goods, which were delayed by a month, would be implemented from March 4. Trump has also unveiled plans for a 25% levy on US imports of steel and aluminum, and has proposed reciprocal tariffs specific to each of the U.S’s trading partners to offset perceived disadvantages for U.S. manufacturers.

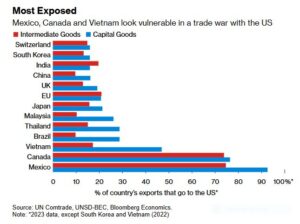

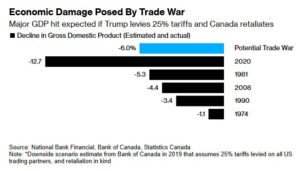

Tariffs of this magnitude could negatively impact Canada and Mexico, which are among the biggest trading partners for the U.S. (Figure 2). With nearly 2 million Canadian workers employed in industries dependent on U.S. demand for Canadian exports, U.S. tariffs would cause steep job losses in Canada, triggering a deep recession. A similar trade-war scenario modeled by the Bank of Canada in 2019 estimated a 6% hit to Canadian GDP (Figure 3). Meanwhile, higher import prices – a result of the weak Canadian dollar and potential reciprocal tariffs imposed by Canada on U.S. goods – could reignite inflationary pressures, raising the risk of stagflation.

Figure 2: Canada sends 75% of its exports to U.S., making it vulnerable in trade war

Figure 3: 6% hit to Canadian GDP from trade war

The downside risk to the TSX was apparent on February 3, when the TSX plunged over 3% at the open on tariff worries, led lower by industrial stocks with cross-border supply chains. While the TSX has traded largely sideways since then, the average index target of strategists (compiled by FactSet) currently stands at just over 29,000, implying 15% upside from the present level of 25,200. In our opinion, that seems far too optimistic.

If implemented, the tariffs may lead the Bank of Canada to continue lowering interest rates to keep the economy afloat. The Bank had reduced its benchmark policy rate by 25 basis points to 3% on January 25, and financial markets are fully pricing in another 25 basis-point reduction at the Bank’s next meeting on March 12.

The economic fallout from the Trump administration’s more radical policies – such as widespread layoffs in the government sector – is being felt in the U.S. as well, with consumer confidence tumbling this month by the most since August 2021 on concerns about the outlook for the economy. A report released last week by the University of Michigan showed that U.S. consumer’s long-term inflation expectations rose to the highest level in almost three decades.

From a portfolio management perspective, though, it helps to see the silver linings amid the dark clouds, such as –

- Financial markets are still not factoring in the worst-case scenario of an all-out global trade war and tit-for-tat tariffs among major nations, and for good reason. This dismal scenario could lead to a global bear market that would also impact the U.S., as a worldwide recession and strong USD put a severe dent in earnings of U.S. multinationals. Many market participants believe that the tariff threats are a means to exert pressure on U.S. trading partners and extract meaningful concessions from them, in which case the most negative outcomes may yet be averted.

- Prior to the looming tariff threats, the Canadian economy was on course for a rare “soft landing”, with slowing inflation and modest economic growth. The economy’s resilience may enable it to withstand the financial shock from tariffs to some extent.

- In addition, the barrage of taunts and threats emanating from south of the border have solidified Canadian resolve to deal with long-standing issues such as diversifying into other export markets, eliminating unnecessary barriers to inter-provincial trade, and unlocking the nation’s vast natural resources responsibly.

- Cessation of hostilities in the Middle East, and between Russia and Ukraine, may support markets in the near term, as geopolitical risk recedes.

- As the Mag Seven pare some of their gains, other U.S. sectors are picking up the slack, with defensive groups like healthcare, consumer staples and utilities outperforming the S&P 500 by a wide margin YTD. Broad market participation is preferable to an advance driven by a handful of stocks, as excessive market concentration can trigger a sudden market slide.

Based on these views, the Portfolio Management Team (PMT) has taken specific steps in recent months to mitigate downside risk as detailed below –

- In January, we made significant changes in the fixed income sleeve of client portfolios. We took profits on a long-standing preferred income fund position, based on our view that the Canadian preferred shares sector did not have an attractive risk-reward profile after a stellar 2024. We also exited our positions in an underperforming bond fund and two long-duration bond ETFs (TLT and TCLB), replacing them with two high-quality, diversified bond ETFs run by top-tier Canadian asset managers. We also rationalized the number of equity holdings in our portfolios, taking profits in two currency-hedged US-focused ETFs and an equal-weight S&P 500 ETF, and deploying the proceeds in the Platinum Growth Fund and a diversified US ETF (RUD).

- In July 2024, we sold our individual stock holdings and allocated the proceeds to actively managed, diversified ETFs, thus eliminating single-stock volatility and improving diversification in client portfolios.

- Given our growing concern about market concentration in the S&P 500 – with the top 10 stocks accounting for almost 40% of the index – we sold the S&P 500 Top 50 ETF (XLG) in November and allocated the proceeds to a multi-factor, diversified U.S. ETF. As a result, the biggest U.S. stocks constitute a much smaller part of our portfolios compared to the underlying benchmark index.

- Our portfolio rebalances in the second half of 2024 and January occurred when indices were near record highs, giving us the opportunity to free up six months of cash for accounts with periodic withdrawals and precluding the need to sell equities in a near-term pullback.

- We continue to actively manage the Platinum Growth Fund to ensure superior performance (the Fund is a top quartile performer in its category over the 6 months, one year and two years to January 31, 2025). In December, we took partial profits in the Pender Small Cap Opportunities Fund, which soared 59% in 2024. In January, we reduced our position in the Fidelity Canadian Opportunities Fund by close to half of its original 19% weight and allocated the proceeds to the EdgePoint Canadian Portfolio, another top-performing Canadian equity fund.

We believe these measures will deliver consistent returns and lower portfolio volatility through enhanced diversification.

The PMT remains vigilant for opportunities created by market volatility, which is likely to increase in the months ahead. The PMT believes that client portfolios are effectively positioned to counter potential market risks through their holdings of actively managed equity ETFs and funds, high-quality fixed income funds and stable alternative investments.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

February 2025 Portfolio Management Team Update

February 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth February 25, 2025 SUMMARY Market Review: Global equities began the year positively with solid returns in January, but volatility in recent weeks underscores the risks that lie ahead. The TSX rose 3.3% last month, trading at a record […]

Read more

2024 IAPW Tax Document Distribution Dates

2024 IAPW Tax Document Distribution Dates There are different mailing dates for different account types. Please click on the link below to view the expected delivery for both mail and online tax slips and reports. 2024 Important Year-End Information – Tax Document Distribution Dates

Read more

January 2025 Portfolio Management Team Update

January 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth January 8, 2025 Summary Market Review: Global equities dipped in December 2024 but achieved strong annual returns for the second consecutive year, led by record-setting gains in North American indices. Volatility in fixed income markets contrasted with relative […]

Read more