Bank of Canada raises rates: Should your mortgage be variable or fixed?

The spread in Canada between a five year fixed rate and a five year variable rate is currently at best 84 bps.

This is assuming Prime is now 3.7%. TD Prime-.9 on a variable=2.8% versus BMO five year fixed at 3.64%.

The odds of rates increasing over 84bps in the next 60 months are extremely high. Therefore, the variable rate product could be at a higher rate than the fixed rate product within only 24-30 months.

Why?

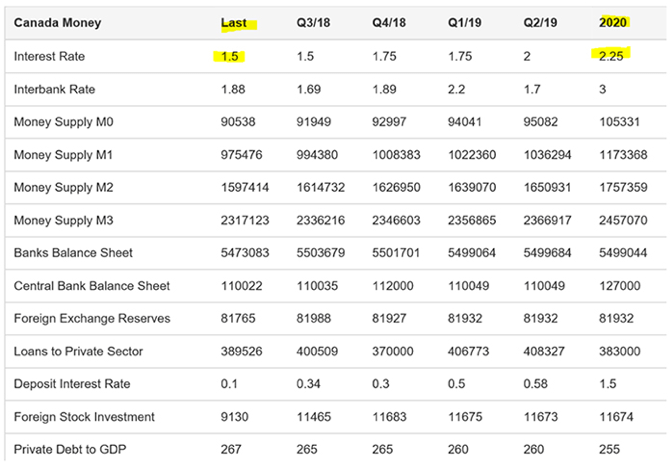

The Federal Reserve dot plot is assuming 7 more raises by the end of 2019: or 175bps with a target of 3 percent by 2020 from 1.5 now.

The Bank of Canada has raised 100bps since March 2017 alone.

Canadian interest rate policy decisions will be heavily influenced by other interest rates: i.e.: the federal reserve of the US, our largest trading partner.

Most expect Canadian rates to go up at least 75bps by 2020: two years.

Source: https://tradingeconomics.com/canada/interest-rate/forecast.

As the price of goods rises, especially in light of new tariffs, we will inadvertently import this US inflation, and Governor Stephen Poloz will have little choice, but to raise short term interest rates in Canada as well.

If not, he risks even more inflation for our importing consumers if the loonie plummets due to interest rate spreads between the two countries.

Source : https://www.cbc.ca/news/business/us-fed-interest-rates-canada-1.4567900

Contact us for more information.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

December 2024 Portfolio Management Team Update

December 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth December 18, 2024 Market Review Global equities turned in a mixed performance in November, as the “Trump Trade” drove North American indices to new highs, while European markets fell amid growing political uncertainty. The TSX Composite surged […]

Read more

November 2024 Portfolio Management Team Update

November 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth November 22, 2024 Market Review Global equities briefly paused their rally in October ahead of the U.S. Presidential elections, before the “Trump Trade” drove U.S. indices to new highs this month. The TSX eked out a 0.65% gain […]

Read more

October 2024 Portfolio Management Team Update

October 2024 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth October 3, 2024 Market Review Global equities advanced to new highs last month to cap a volatile quarter, as interest rate cuts by major central banks boosted optimism for a soft landing despite mixed economic data. The TSX […]

Read more