April 2023 Portfolio Management Team Update

April 2023 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Portfolio Manager, iA Private Wealth

April 25, 2023

Market Review

Global equities were mixed in March, as concern about systemic financial risk led many indices lower. U.S. indices bucked the trend to post gains – despite two of the largest bank failures in history – on optimism that the Federal Reserve may be nearing the end of its interest rate hikes. Overall, January’s stellar performance enabled most indices to finish the quarter with significant gains.

The TSX Composite retreated 0.6% in March, led by declines in its two largest sectors – financials and energy. The financials sector was marginally higher in the first quarter while energy was the only decliner in Q1. Diverse sectors such as technology, materials, utilities, consumer staples and industrials moved significantly higher last month for gains of at least 5% each in Q1.

In the U.S., the S&P 500 rose 3.5% in March for a Q1 gain of 7.0%, on the heels of a 7.1% increase in the preceding quarter. While the Dow Jones Industrial Average rose 1.9% in March to trade marginally higher (+0.4%) over the quarter, the Nasdaq Composite surged 6.7% last month for a Q1 gain of 16.8%, as it continued to rebound from a 33.1% plunge in 2022.

Several European indices also recorded double-digit gains in Q1. Major emerging markets were mixed over the quarter, with China’s Shanghai Composite up 5.9%, India’s Sensex down 3.0% and Brazil’s Bovespa index among the worst performers with a 7.2% decline. (Data Source: FactSet).

Our Strategy

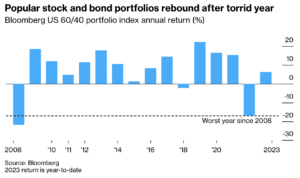

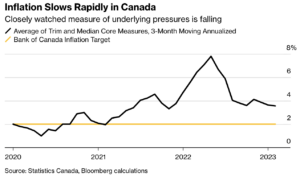

The global equity rebound in Q1, combined with the substantial decline in bond yields, has repaired part of the damage inflicted on balanced portfolios in 2022 (Figure 1). This recovery in asset prices has been driven to a large part by investor optimism that the relentless rate hikes of the past year may be coming to an end, as core measures of inflation show that price pressures are abating (steep prices for groceries and essentials notwithstanding) (Figure 2).

The Bank of Canada said as much on April 12 after leaving the benchmark interest rate unchanged at 4.5% for its second straight meeting, noting that recent data is reinforcing its confidence that inflation pressures will abate. However, the BoC kept its options open with regard to additional hikes, should the Canadian economy surprise to the upside.

At the present time, escalating concern about systemic risk in the global financial system that had caused near-panic in mid-March has largely dissipated. Investors’ attention has now turned to fundamentals such as earnings expectations and growth prospects against the backdrop of a widely-anticipated economic slowdown.

Analysts have lowered 2023 index earnings estimates for the TSX and S&P 500 by about 11% over the past year, so the trillion-dollar question is whether or not companies can surpass these lowered estimates. The current Q1 “earnings season” should provide some clues about the earnings and economic outlook for the remainder of 2023.

The 5.4% YTD gain in the TSX gives it a forward price/earnings (P/E) valuation of 13.9x (based on the 2023 EPS estimate of $1,476). For the S&P 500, its 6.0% gain has it trading at a forward P/E of 18.6x (based on 2023 forecast EPS of $218.5). Note that earnings for 2024 are forecast to grow by about 12% for both indices in 2024. (EPS data source: FactSet).

The Portfolio Management Team (PMT) completed a review of its asset allocation earlier in April, and decided to leave it unchanged at the present time. The PMT also rebalanced all model portfolios this month to implement a couple of changes. Specifically, we sold an underperforming hedge fund in our “Alternatives” sleeve, and deployed the proceeds in two leading liquid alternative ETFs; we also took some money off the table in stocks like Salesforce (+44% YTD). The PMT believes these changes position client portfolios appropriately for seasonal market volatility that typically erupts from May onwards.

Figure 1: 60/40 is Back

Figure 2: Price pressures are abating

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

February 2025 Portfolio Management Team Update

February 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth February 25, 2025 SUMMARY Market Review: Global equities began the year positively with solid returns in January, but volatility in recent weeks underscores the risks that lie ahead. The TSX rose 3.3% last month, trading at a record […]

Read more

2024 IAPW Tax Document Distribution Dates

2024 IAPW Tax Document Distribution Dates There are different mailing dates for different account types. Please click on the link below to view the expected delivery for both mail and online tax slips and reports. 2024 Important Year-End Information – Tax Document Distribution Dates

Read more

January 2025 Portfolio Management Team Update

January 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth January 8, 2025 Summary Market Review: Global equities dipped in December 2024 but achieved strong annual returns for the second consecutive year, led by record-setting gains in North American indices. Volatility in fixed income markets contrasted with relative […]

Read more