Market Review

Global equities surged to new highs in July as inflation concerns abated, before the worst bout of volatility since 2022 erupted in the first week of August, taking the S&P 500 to the brink of a correction.

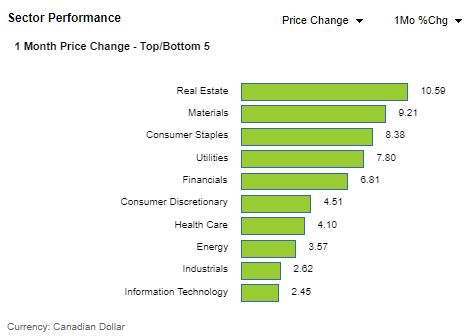

The TSX gained 5.65% last month for its best monthly performance since November 2023. The index traded above the 23,000 level for the first time ever on July 31 as it posted its 14th record for the year. July’s gains in the TSX were broad-based as all 11 sectors advanced, led by interest rate-sensitive and defensive groups including real estate, consumer staples, utilities and financials. Commodity-related sectors such as materials and energy also posted solid gains (Figure 1).

In the U.S., the S&P 500 closed the month with a 1.13% gain, hitting an intra-day record of 5,669.67 on July 16. The index was weighed down in the second half of the month by declines in some of the technology mega-caps, after their earnings reports led to concerns about the payoff from their massive investments in AI. The influential technology and communication services sectors retreated 2.1% and 4.2% respectively in July on profit-taking. The technology sell-off resulted in the Nasdaq Composite declining 0.75% in July, while the Dow Jones Industrial Average rose 4.41%, trading above 40,000 for the first time.

Sector rotation was a notable feature of market performance in July, as investors exited the “safety trade” of mega-cap technology into lagging sectors including small-cap shares and value stocks. The Russell 2000 index of small-cap stocks outperformed the Nasdaq 100 by 5.8 percentage points on July 11, the biggest margin since November 2020. The Russell 2000 surged 10.10% in July, outperforming the large-cap Russell 1000’s 1.37% gain by a huge margin.

Overall, the MSCI AC World Index advanced 1.08% in July, as gains in North American and European indexes were offset by declines in major Asian bourses including Taiwan, Hong Kong and Japan.

(Sources: FactSet, Bloomberg)

Source: FactSet

Unusual Volatility

The August-October period, which has historically been the most volatile period for equities, commenced on a negative note as stocks plunged in the first week of this month. U.S. stocks fell on August 2 following an unexpectedly weak jobs report, the worst reaction to jobs numbers in almost two years. The report fuelled worries that the Federal Reserve’s decision earlier in the week to hold interest rates unchanged at a two-decade high risked plunging the U.S. economy into a deeper economic slowdown.

Global equities sold off in a near panic on August 5, as the Nasdaq plunged 6% at the open, Japan’s Nikkei-225 index nosedived 12%, and the CBOE Volatility Index (the “VIX”) registered its largest spike since 1990. Apart from weak economic data and uninspiring corporate earnings, investor sentiment was also impacted by news that Warren Buffett had slashed Berkshire Hathaway’s stake in Apple and other stocks, boosting the conglomerate’s cash position to the high levels that prevailed before the 2008 financial crisis.

The stock rout was especially severe in Japan, with the Nikkei-225 and Topix index both tumbling by a record 20% in a three-day period, before rebounding 10% on August 6. The Japanese selloff was triggered by the Bank of Japan’s July 31 decision to raise its interest rate for only the second time in 17 years. With the Japanese yen having appreciated sharply since early July in anticipation of tighter policy, traders were forced to unwind “carry trades,” which involve borrowing cheaply in Japan and investing elsewhere for higher yields. As traders liquidated assets across the board to repay their yen borrowings – since the stronger yen can erode or even reverse gains from carry trades – markets encountered intense selling pressure on August 5.

Outlook & Portfolio Strategy

Although equity markets have dusted off the volatility from earlier this month and recouped most of their losses, the jury is still out on whether the recent meltdown – which erased $6.4 billion from global stock markets in a three-week period – was a one-off event or a harbinger of more volatility in the weeks ahead.

While the U.S. economy could be slowing down appreciably, earnings from S&P 500 companies are still robust. According to FactSet, the blended earnings growth (based on actual results + estimated results for companies that have yet to report) for the S&P 500 for Q2 2024 is 10.8%, the highest in 2½ years. The blended year-over-year revenue growth rate for the S&P 500 is 5.2%, the highest since Q4 2022 and the 15th consecutive quarter of revenue growth for the index.

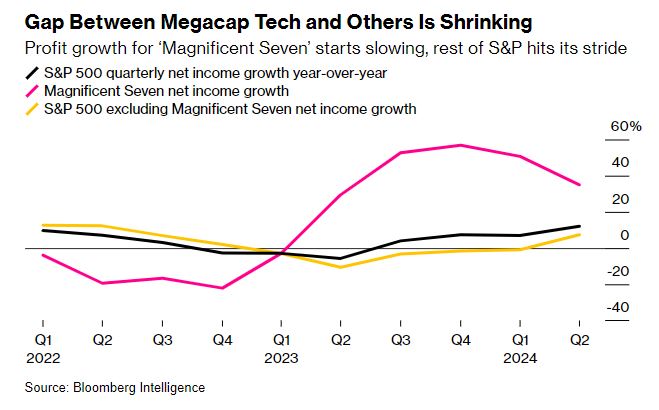

In addition, after several quarters where the “Magnificent Seven” were the primary drivers of profit growth for the S&P 500, the rest of the stocks in the index are finally poised to contribute, as they are currently on track to report their first growth in earnings since Q4 of 2022 (Figure 2).

As mentioned in last month’s report, the Portfolio Management Team (PMT) made some significant changes to its large model portfolios in mid-July, selling individual stock positions and deploying the proceeds in diversified, actively managed ETFs. We discuss some of the key impacts of these changes below, and why we believe they position client portfolios adequately for the future.

- Geographic exposure tweaks – One of the major changes in the recent portfolio rebalance was that we increased our U.S. equity exposure while lowering our Canada weight. We were previously slightly underweight the U.S., which had impacted our portfolio returns since the U.S. has outperformed Canada substantially over the past decade. In our view, U.S. market leadership is likely to be unchallenged in the next few years given its dominance in technology in general and AI in particular. If the global economy is heading for a rough patch, the U.S. may be positioned to emerge from the resultant slump faster and in better shape than Canada. Increasing U.S. exposure therefore implies better upside capture for our portfolios.

- Enhanced diversification through ETFs – Our portfolios held up better than market indices in the recent selloff, partly because the diversified ETFs that replaced our individual stocks have dampened overall portfolio volatility. Stocks have been reacting to earnings reports more intensely than usual. According to Citigroup data, stocks in the S&P 500 were fluctuating by an average of almost 5% (+ or -) after posting Q2 earnings, compared to the historical average of 3.3%, while earnings-day moves were also the highest in 12 years.

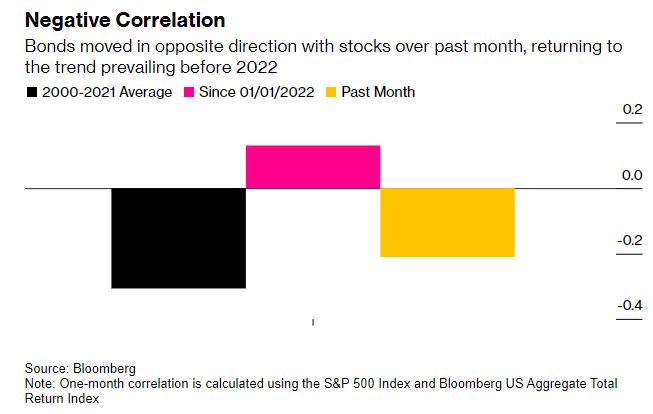

- Downside protection from fixed income – Fixed income instruments were a sore disappointment in 2022, as the Federal Reserve’s aggressive rate hikes caused stocks and bonds to plunge, leading to the worst performance in decades for balanced portfolios like the traditional 60/40 one. However, as interest rates peak globally and with the Fed poised to join the Bank of Canada in reducing interest rates as early as next month, bonds are now back in favor as vital components of a diversified portfolio. The one-month negative correlation between stocks and bonds has reverted to its historical status (Figure 3), which means that if equities slump in the next few months, bonds should rally and cushion some of the downside.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.