The spread in Canada between a five year fixed rate and a five year variable rate is currently at best 84 bps.

This is assuming Prime is now 3.7%. TD Prime-.9 on a variable=2.8% versus BMO five year fixed at 3.64%.

The odds of rates increasing over 84bps in the next 60 months are extremely high. Therefore, the variable rate product could be at a higher rate than the fixed rate product within only 24-30 months.

Why?

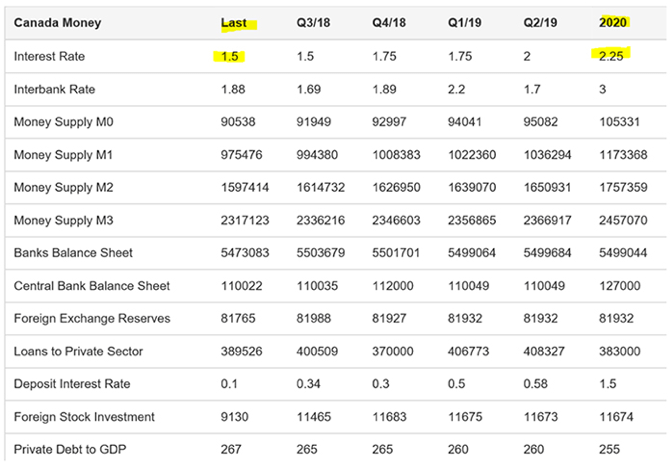

The Federal Reserve dot plot is assuming 7 more raises by the end of 2019: or 175bps with a target of 3 percent by 2020 from 1.5 now.

The Bank of Canada has raised 100bps since March 2017 alone.

Canadian interest rate policy decisions will be heavily influenced by other interest rates: i.e.: the federal reserve of the US, our largest trading partner.

Most expect Canadian rates to go up at least 75bps by 2020: two years.

Source: https://tradingeconomics.com/canada/interest-rate/forecast.

As the price of goods rises, especially in light of new tariffs, we will inadvertently import this US inflation, and Governor Stephen Poloz will have little choice, but to raise short term interest rates in Canada as well.

If not, he risks even more inflation for our importing consumers if the loonie plummets due to interest rate spreads between the two countries.

Source : https://www.cbc.ca/news/business/us-fed-interest-rates-canada-1.4567900