(This article was written on March 18, 2020; all market data is of close on that date).

SUMMARY

- The global economy has not faced a worldwide threat like the COVID-19 pandemic since the Second World War. This is probably the first time in decades that large swathes of the global economy are grinding to a complete stop for an unknown number of months.

- We are not yet at the bottom of the equity rout but may be getting close to it. We may be close to reaching bottom when investors begin to discount the endless barrage of bad news, resulting in a sustainable market rally that stays intact for a number of days. For this to occur, however, we would need to see positive news flow that indicates the pandemic may be coming under control.

- Although Canada and the U.S. are likely headed for a recession, moving to cash in your portfolio now to sidestep a further market decline would be the worst possible course of action, as it would lock in portfolio losses, with no possibility of participation in the eventual rebound.

- We believe this is the right time to add funds to your portfolio, as long as your investment horizon is at least three to five years out, and you are comfortable with current elevated levels of market volatility. That said, we do not advocate using borrowed funds to invest in the market.

- We have taken steps to mitigate the effects of the “Coronavirus Crash” on client portfolios, by holding 40% fixed income and alternative investments in our Pension balanced portfolio, 20% in US dollar-denominated securities, and actively rebalancing through this market meltdown.

- There are some silver linings in the dark clouds that currently hover over the global economy. The U.S. has taken steps to increase testing capability and reduce wait times, while leading pharmaceuticals and biotechs are racing to develop vaccines and therapies to combat the virus. There is also some evidence that summer’s higher temperatures and humidity may slow the spread of the coronavirus.

_____________________________________________________________________________________

Just a month ago, global indices were at record highs as investors and investment professionals dismissed the ominous, looming presence of the biggest risk factor to public health in a century and the biggest threat to the global economy in many decades.

Since then, stock markets around the world have been in virtual freefall, posting some of their biggest one-day declines on record. U.S. indices have hurtled to a bear market in less than a month despite aggressive action by the Federal Reserve and a trillion-dollar fiscal stimulus package in the works.

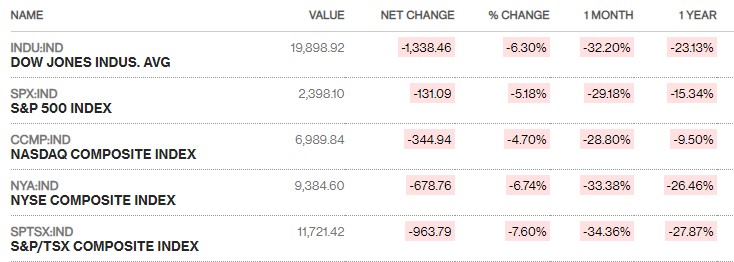

At the time of writing (March 18), another frenzied bout of selling has taken the TSXS Composite down by almost 1,000 points on the day to trade below the 12,000 level. One-month and one-year performances for the TSX and major U.S. indices are as follows (Figure 1):

Figure 1: Performance of major North American indices

Source: Bloomberg

Against this dismal backdrop and given the heightened sense of uncertainty that we all feel, we have attempted to answer some of the frequently asked questions (FAQ) posed to us by our clients and other investors. While it may be weeks or months before we see a sustained rebound in the markets and economy, we are somewhat optimistic that the worst of the selloff may be behind us and view current market levels as a buying opportunity for the long-term.

1) Why has the stock market reacted so adversely to the coronavirus?

The global economy has not faced a worldwide threat like the COVID-19 pandemic since the Second World War. This is probably the first time in decades that large swathes of the global economy are grinding to a complete stop for an unknown number of months.

When the coronavirus first surfaced in China in late December, the initial reaction from investors was that it was a localized outbreak that would remain contained within the nation, thanks to the draconian lockdown and quarantine measures that were swiftly put into place by the Chinese government. Optimism that these measures would help to quell the outbreak fueled investor complacency, as evidenced by North American stock markets reaching record highs on February 19-20.

However, concerns that COVID-19 could become the first lethal pandemic in a century began escalating from the fourth week of February onward, as numerous nations around the world reported their first cases of the coronavirus, with the total number of cases and deaths increasing exponentially since then.

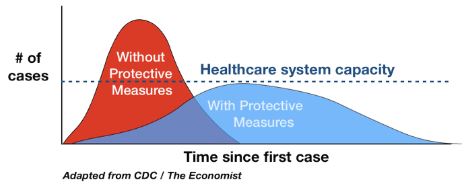

The economic toll of the coronavirus is soaring by the day due to the “social distancing” and quarantine measures necessary to slow down the progression of COVID-19 through the population, as authorities in every nation desperately try to keep the number of critically ill patients from overwhelming their healthcare systems. “Flattening the curve” (Figure 2) is now not just a statistical construct, but a matter of life-or-death.

Figure 2: Flattening the Curve

In sum, here are three reasons why equities have just recorded the fastest bear market in history, in our opinion:

- Widespread economic damage: Equity indices were at record highs coming into this shock, with valuations already stretched and a high bar set for corporate earnings. Judging by China’s experience so far, the cost of the coronavirus on the U.S. and global economies will be colossal. Bloomberg Economics1 estimates that China’s GDP was about 20% lower in the first two months of 2020 compared with a year ago, with store traffic plunging as much as 80% at the peak of the outbreak, services output plummeting as much as 70% and manufacturing down 30%-35%.

In North America, numerous sectors have already been severely affected, with airlines, cruise ships, restaurants and malls among the worst hit. The damage has spread to the financial sector, with fears of a recession and record-low interest rates affecting banks and insurance companies. Stresses are building up in the global financial system, leading to fears of another credit crisis. In a bid to salvage their portfolios, investors are also selling securities such as fixed income and gold producers that had been holding up relatively well until recently. There seem to be no safe havens in the current intensely bearish climate. As well, the widespread economic damage inflicted by the virus will translate into a massive hit to corporate earnings this year.

- Huge degree of uncertainty about the coronavirus: This is a novel coronavirus, which means that it is an unknown entity that medical professionals are still struggling to understand. Its highly contagious and mobile nature, along with a symptom-free incubation period that can range from a few days to two weeks, poses overwhelming challenges to the global population and national health systems. At the present time, there is no vaccine or cure for the coronavirus, and there is no timeline about how long social distancing and other measures may need to be implemented to check its rampant spread. As market strategist Jim Paulsen noted this week, “Give me bad news any day over complete uncertainty.”

- Oil shock: The collapse in oil prices this month, precipitated by an all-out price war between Saudi Arabia and Russia, could not have occurred at a worse time for the global economy in general and Canada in particular. Oil prices have slumped to a two-decade low as oil supplies have ramped up just as demand has fallen sharply. The 45% plunge in crude oil since March 6 has decimated the energy sector around the world, with the impact felt especially hard in Canada, which has the highest exposure to energy among the G-7 nations.

2. Are we at the bottom of this equity rout?

Not yet, but we may be getting close to it.

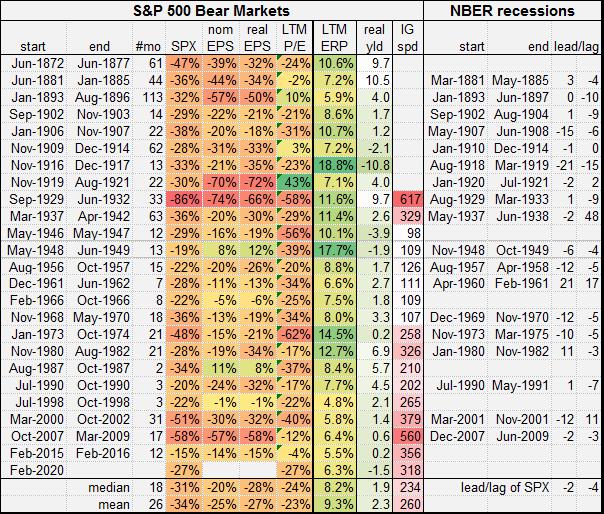

According to Jurrien Timmer, Director of Global Macro at Fidelity Investments, the median decline for the S&P 500 – based on all bear markets since 1872 – is 31%, with an average drop of 34% (see Figure 6 at end of article).

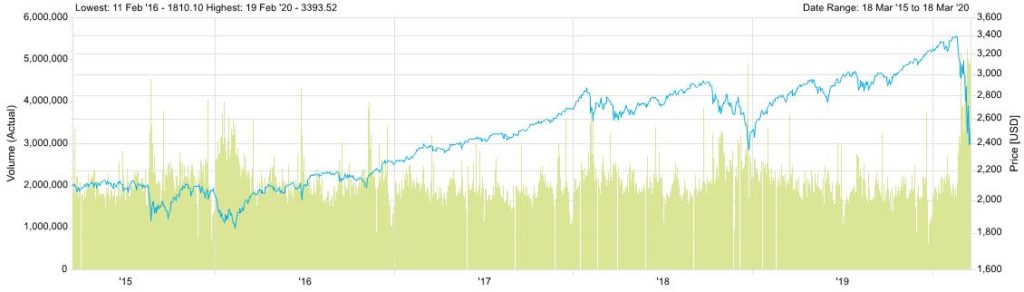

Based on its March 18 closing level of 2,398.10, the S&P 500 is down 29.3% from its peak. A 35% decline from its top would take it to about 2,200 (a key support level), or about 8% below current levels.

Timmer also expects a 10% hit to earnings per share (EPS) for the S&P 500 over the next two quarters, from $163 to $147. Applying a 17x earnings multiple to EPS of $145 results in an index level of 2,466. According to Timmer, this implies that investors have already priced in most of the downside.

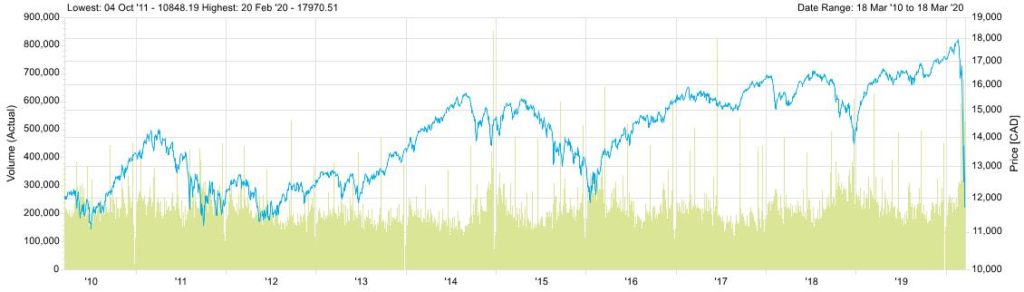

Market professionals also watch key levels to determine where the index may find support. The S&P 500 breached support at 2,400 in intra-day trading on March 18, but then recovered in the final hour of trading to close just below that level. We believe the next support levels are at 2,200 and then at 2,000 (Figure 3). As for the TSX Composite, having already broken through strong support around 12,000 (Figure 4), support lies in the 11,500 region and then at 10,000, in our opinion.

Figure 3: S&P 500: 2015 – 2020

Source: FactSet

Figure 4: TSX Composite: 2010 – 2020

Source: FactSet

3) What are the signs that we may be close to reaching a bottom?

Rather than economic data, which will be viewed as “stale” because of the speed with which the pandemic has been unleashed, investors will be looking for signs that the number of coronavirus cases are levelling off. Particular attention is being paid to the total number of cases in the U.S., which are spiraling by the day; over 2,300 cases were reported in a 12-hour period ending 6 pm on March 18, bringing the total number of cases in the U.S. to over 8,700.

Some experts consider the U.S. to be about 10 days behind Italy2 in terms of the progression of the coronavirus. Apart from China, Italy has been the nation hit hardest by COVID-19, with about 3,500 new cases every day and a death toll that already exceeds 2,500. A lockdown that was initially implemented in the northern part of the country, where the highest concentration of coronavirus cases is located, was extended to the entire nation on March 13. Signs that this unprecedented lockdown is slowing down rapid growth in new cases in Italy would provide a glimmer of hope to investors.

Market action has been frenetic in recent days, with multi-day bouts of selling followed by a brief recovery, before the selling resumes. While a market bottom can only be identified in retrospect, in our opinion, we may be close to reaching one when investors begin to discount the endless barrage of bad news, resulting in a sustainable market rally that stays intact for a number of days. For this to occur, however, we would need to see positive news flow that indicates the pandemic may be coming under control. Key support levels for the major indices must also hold for a market rebound to occur.

4) Is Canada / U.S. / the global economy headed for a recession?

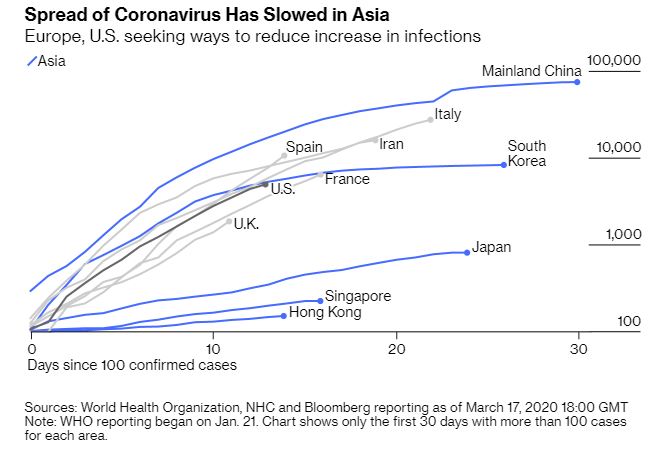

Quite possibly, although the optimistic expectation currently is that a recession will be a short (if deep) one, rather than a long-drawn slowdown. Much depends on how the coronavirus progresses in the U.S. and Europe. China is making slow but steady progress in rebooting its giant economy after the huge virus-induced slowdown, as new virus cases dwindle to a handful (Figure 5). In fact, the nation just reported zero local infections3 for the first time since the coronavirus crisis began three months ago.

The substantial amount of monetary and fiscal stimulus that governments around the world have unveiled to combat the virus-induced slowdown may help counter the worst effects of a potential recession, while the resurgence of pent-up consumer demand could help speed the recovery. It should be noted that some economists place the odds of a U.S. recession in 2020 at over 50%, while some market participants believe the U.S. may already be in a recession. Many economists feel that Canada is inevitably headed for a recession, due to a combination of the dual oil and COVID-19 shocks and slowing global demand.

Figure 5: Number of coronavirus cases in various nations (as of March 17, 2020)

5) So should we sell everything and move to cash, to sidestep another 25% market decline?

Moving to cash at this stage would be the worst possible course of action, as it would lock in portfolio losses, with no possibility of participation in the eventual rebound. While it may sound easy to move to cash now and get back in when the markets begin to rally, “timing the markets” is very difficult to execute and is simply an exercise in futility, as most professionals will attest.

6) Is this the right time to add money to our investment portfolios?

We believe this is the right time to add funds to your portfolio, as long as your investment horizon is at least three to five years out, and you are comfortable with current elevated levels of market volatility.

7) Should we borrow from our line of credit to invest in the markets?

We do not advocate using leverage to invest, since it can exacerbate investment losses and lead to compressed investment horizons, which can be dangerous during a volatile time like the present.

8) What steps has Luft Financial taken to mitigate the effects of the “Coronavirus Crash” on my portfolio holdings?

As mentioned in our February 28 “Macroscope”, we had taken steps in recent months to lower the risk profile of our portfolios and mitigate declines. In our flagship “Pension” balanced model (which has a 60% equity allocation), the decline so far this year has been less than one-half that of the TSX and S&P 500. This is due to the 40% weight in fixed income and alternative investments, as well as the approximate 20% allocation to US dollar-denominated securities. The Canadian dollar’s 11% plunge against the USD so far this year offsets part of the decline in U.S. stocks. Thus, the S&P 500’s 25.5% YTD decline translates to a drop of 16.5% in CAD terms. We have been actively rebalancing through this market meltdown, taking profits from our fixed income positions (which had been holding up well until very recently, as the selling has turned more indiscriminate) and using the proceeds to add to positions in our blue-chip holdings.

9) What can we expect next in terms of measures to support the market?

There have been some rumblings that stock markets could be closed for a few days to dissipate investor panic, but the general feeling is that this may be a bad idea. Some exchanges are toying with the idea of introducing shorter trading hours as a temporary measure, as thousands of traders and financial industry professionals are now working from home (which could have had a detrimental effect on market liquidity and may be part of the reason for the wild market swings in recent days). A temporary ban on short selling is also a slim possibility, in our view.

10) Finally, are there any reasons for optimism?

Investors are typically unrestrainedly euphoric at market peaks, and the flip side to that phenomenon is the sheer despair displayed in the depths of bear markets. We have no way of knowing if the relentless and indiscriminate selling so far this month is indicative of “capitulation” selling, or whether there is more downside to come. While dark clouds may hover over the global economy for months, there are some silver linings in them. One of the key measures to control the spread of the virus is more testing and faster results. On March 12, the U.S. approved a new coronavirus test that will speed up the ability to test patients by 10-fold, while on March 16, the U.S. FDA took steps to reduce the wait time for tests. Earlier this week, the first human trial4 for a COVID-19 vaccine took place in Seattle, the epicenter of the U.S. outbreak. Pharmaceutical giants like GlaxoSmithKline, Sanofi and Johnson & Johnson are also working on experimental vaccines for COVID-19, although it must be stressed that any vaccine is still more than a year away. Biotech giants Regeneron and Gilead Sciences are developing therapies that show promise in treating COVID-19. Finally, there is some evidence that summer’s warmer temperatures could slow the spread of the coronavirus5. Hopefully there’s some truth to the old saying that “it’s always darkest before dawn.”

References

3 https://www.nytimes.com/2020/03/18/world/asia/china-coronavirus-zero-infections.html

Figure 6: S&P 500 bear markets since 1872

Source: Fidelity Investments

________________________________________________________________________________

This information has been prepared by Robert Luft and Elvis Picardo, who are Portfolio Managers, and Aaron Arnold, who is an Investment Advisor, for HollisWealth® and does not necessarily reflect the opinion of HollisWealth®. HollisWealth® is a division of Industrial Alliance Securities Inc., a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Robert Luft, Elvis Picardo and Aaron Arnold can open accounts only in the provinces in which they are registered. For more information about HollisWealth, please consult the official website at www.holliswealth.com. Luft Financial is a personal trade name of Robert Luft.