Market Review

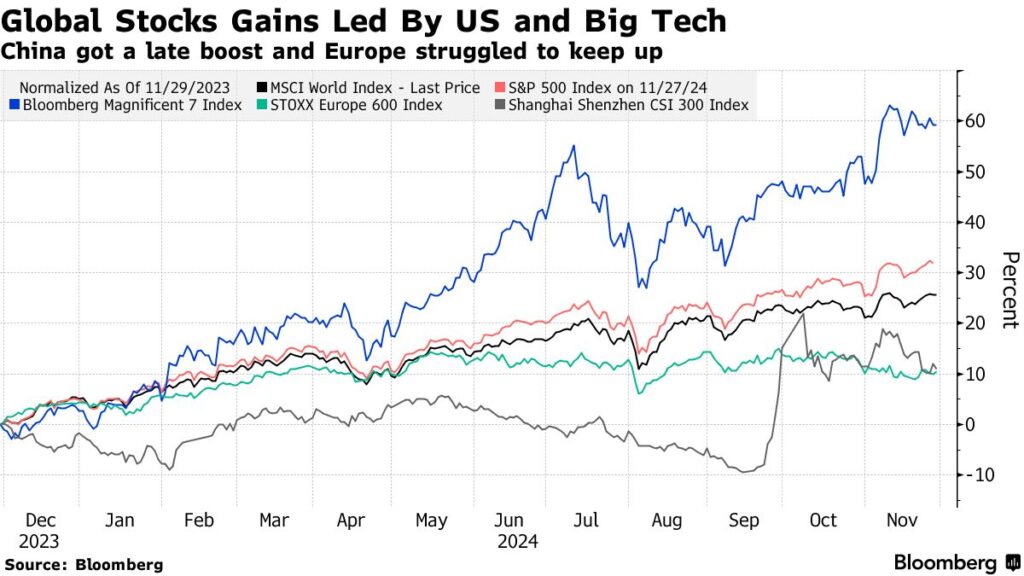

Global equities turned in a mixed performance in November, as the “Trump Trade” drove North American indices to new highs, while European markets fell amid growing political uncertainty.

The TSX Composite surged 6.2% last month – its best performance since November 2023 – for its fifth straight monthly advance, taking its year-to-date gains to 22.4%. November’s gains were led by multiple sectors – technology, financials, consumer staples, energy, and industrials. Nine of the TSX’s 11 sectors had posted double-digit gains (as of end-November), an indication of the breadth of this year’s rally. Communication services was the worst performer last month with a decline of 7.1%. The sector was the only of the TSX’s 11 groups to be in the red for the year, with a 17.5% plunge YTD.

In the U.S., the S&P 500 rose 5.7% in November, as the biggest post-election gains in history propelled its best monthly performance this year, taking its YTD gains to 26.5%. The Dow Jones Industrial Average gained 7.5% (+19.2% YTD), while the Nasdaq Composite advanced 6.2% (+28.0% YTD). Optimism that the incoming U.S. administration’s focus on boosting domestic businesses would benefit smaller firms triggered a 10.8% surge in the Russell 2000 in November, outpacing the 6.3% gain in the large-cap Russell 1000.

In Europe, a political crisis in France led to a 1.6% pullback in the CAC-40 index. Most European and Asian indexes traded lower last month on concerns about President-elect Trump’s protectionist policies and tariff threats. Overall, the MSCI AC World Index rose 4.0% last month for a YTD gain of 20.5%.

(Sources: FactSet, Bloomberg)

Economic Highlights

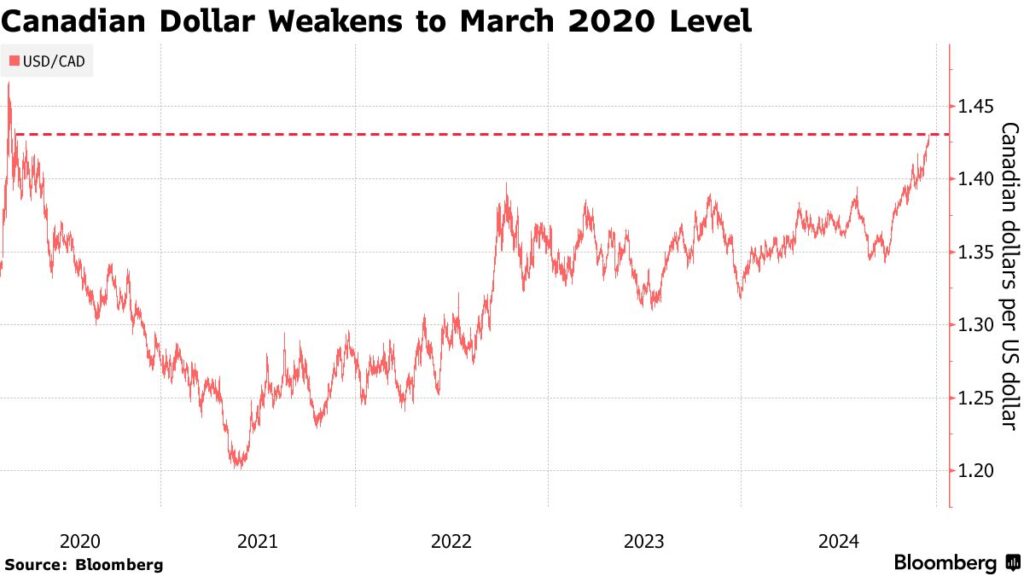

On December 11, the Bank of Canada again lowered its benchmark overnight rate by 50 basis points to 3.25%, bringing its cumulative rate cuts to 175 basis points in just over half a year, the fastest pace of monetary easing among advanced economies. The Bank said its decision was based on inflation having returned to around 2%, excess supply in the Canadian economy, and recent indicators suggesting economic growth may be softer than projected.

The Bank noted that the possibility of new tariffs imposed by the U.S. on Canadian exports has increased uncertainty about the economic outlook. However, it signaled that additional rate cuts would be at a more gradual pace, with the need for further rate reductions evaluated “one decision at a time.”

In the U.S., the Federal Reserve lowered the federal funds rate on December 18 by 25 basis points to a range of 4.25% – 4.50%. The third consecutive easing move by the Fed brings cumulative rate cuts since mid-September to 100 basis points. Fed officials reined in expectations for additional rate reductions in 2025, signaling two 25 basis-point cuts, compared with market expectations for three such trims.

Outlook & Portfolio Strategy

Speculative appetite has resurfaced with a vengeance since the U.S. Presidential election, evidenced by soaring prices for crypto assets and meme stocks. While the mania has not yet reached the fever-pitch of 2021, the signs are troubling, and in our opinion, warrant some caution as we head into 2025.

Global appetite for U.S. assets of all stripes (Figure 1) has further widened the gap between the U.S. and the rest of the world, with U.S. market capitalization now accounting for two-thirds of the global total, up from about 50% a decade ago (Figure 2). This divergence has widened with the AI boom that has added a staggering $8 trillion over the past couple of years to the combined market values of American “Big Tech” (Amazon, Apple, Google, Microsoft, Meta, and Nvidia).

With U.S. stock valuations now approaching record levels (Figure 3), the Portfolio Management Team (PMT) has taken specific steps to mitigate downside risk as detailed below –

- We rebalanced all client portfolios in the third week of November, taking advantage of indices’ all-time highs to free up six months of cash for accounts with periodic withdrawals, thus precluding the need to sell equities in a near-term pullback.

- While global equity indices are heavily tilted towards the U.S. – because of its two-thirds weight, as noted earlier – the equity sleeve of our portfolios are better diversified, with a target allocation of 25% Canada, 25% international markets, and 50% U.S.

- The dominant contribution of the “Magnificent 7” (the six companies mentioned earlier plus Telsa) to S&P 500 profits is a growing concern as their phenomenal growth rates slow down and the rest of the index catches up. While these seven stocks account for more than one-third of the S&P 500, they constitute a proportionately much smaller part of our portfolios. To further reduce our exposure to the biggest U.S. stocks, in the recent rebalance, we sold the S&P 500 Top 50 ETF (XLG) – a long-term holding – and ploughed the proceeds into a multi-factor, diversified U.S. ETF.

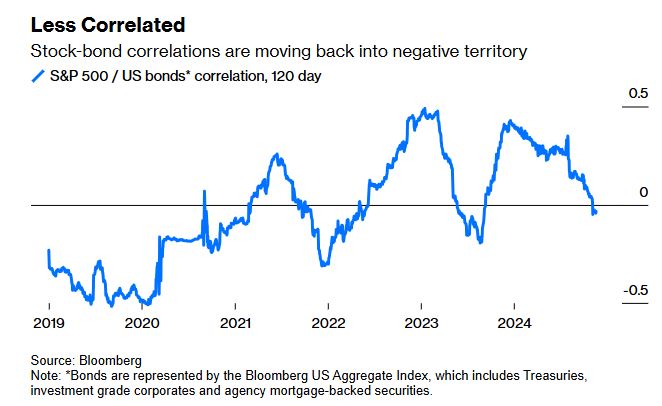

- Our balanced growth portfolios comprise 60% equity funds and ETFs, with the remaining 40% in fixed income and alternative investments. With yields on our fixed income funds above 4% and the correlation between stocks and bonds reverting to negative territory (if stocks prices fall, bonds will rise and vice versa), the fixed income component should cushion part of potential equity downside in diversified portfolios.

- Finally, the changes made to client portfolios in July have worked out well in terms of enhancing upside capture while mitigating downside risk. Those changes involved selling individual stocks and allocating the proceeds to actively managed, diversified ETFs.

In recent weeks, political uncertainty in Canada has been in the spotlight, following Finance Minister Freeland’s resignation. While these developments are concerning, such political developments tend to have limited impact on equity markets. However, it may be the last straw for the struggling Canadian dollar, where a combination of broad USD strength, looming tariffs and an adverse interest-rate differential (versus the USD) has sent the loonie tumbling 8% YTD to its 2020 pandemic low.

In this scenario, having a substantial allocation to U.S. and international markets – as is the case with our client portfolios – is an additional risk mitigation measure. Overall, we believe that the portfolio changes we made in the second half have positioned client portfolios adequately for the challenging year ahead.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.