January 2025 Portfolio Management Team Update

January 2025 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth

January 8, 2025

Summary

Market Review: Global equities dipped in December 2024 but achieved strong annual returns for the second consecutive year, led by record-setting gains in North American indices. Volatility in fixed income markets contrasted with relative calm in equities. U.S. and Canadian bond yields diverged, with the U.S. 10-year Treasury yield rising to 4.66%, while Canadian 10-year bonds saw a modest increase to 3.34%. The Canadian dollar depreciated 8.3%, reflecting weaker bond yields and U.S. dollar strength.

Economic Highlights: The Canadian economy lagged behind the U.S., with GDP contracting slightly in late 2024. The Bank of Canada cut rates aggressively, bringing the overnight rate to 3.25%, but signaled a slower pace of easing in 2025. In contrast, the Federal Reserve lowered its federal funds rate by 100 basis points in 2024 and hinted at moderate rate cuts in 2025.

Rebalances and Risk Mitigation: The PMT rebalanced portfolios in July and November, raising cash at market highs. To address risks from elevated stock valuations and potential volatility, the PMT moved from individual stocks to diversified ETFs, and reduced exposure to concentrated sectors like the “Magnificent 7.” It expects to make changes shortly to the fixed income sleeve, focusing on improving credit quality and reducing positions with unfavorable risk-reward profiles.

Performance: Our Balanced growth and growth-oriented portfolios returned 13.66% and 16.20% respectively in 2024, with the core Platinum Growth Fund gaining 26.6%.

Market Review

Global equities retreated in December, but investors had little cause for complaint as stocks posted solid gains for the second successive year, led by North American indices’ steady march to record highs in 2024.

The TSX fell 3.6% in December, its worst monthly performance in 2024, a reversal from the 6.2% gain in November that was its best showing in a year. The index advanced 3.0% in the fourth quarter (Q4) to trade above the 25,000 level for the first time, following a Q3 gain of 9.7% that was its best quarterly performance in four years.

Overall, the TSX gained 18.0% in 2024, its best annual performance since 2021. Index gains were broad-based, with the communication services group the only one to finish in the red with a 26.5% plunge over the year. Three of the four biggest sectors on the TSX – financials (+25.0%), energy (+18.2%) and materials (+19.3%) – were significant contributors to index performance, with technology (+37.7%) and consumer staples (+17.3) the other groups to post double-digit gains.

The S&P 500 retreated 2.5% in December, after a 5.7% advance in November that was propelled by the biggest post-election gains in history. The index rose 2.1% in Q4 for its fifth straight quarterly advance. Overall, the S&P 500 gained 23.3% in 2024 following a 24.2% surge in 2023, the best two-year gain since the late 1990s. The index soared 53% over this two-year period, rising from a level below 4,000 at the beginning of 2023 to trade above 6,000 in Q4.

While the market rally showed signs of broadening out in the second half of the year, technology mega-caps were dominant performers yet again in December, led by Broadcom’s 43% surge in the month that made it the latest entrant to the trillion-dollar market-cap club. At year-end, the combined weight of the 10 biggest stocks in the S&P 500 had reached a record 38.7%. The “Magnificent 7” contributed 55% of the S&P 500’s return in 2024, down from 63% in the previous year but up from 33% in 2021 (Figure 1).

The Dow Jones Industrial Average (DJIA) traded at a new high above 45,000 in early December before trending lower to end the month down 5.3% and paring its Q4 advance to 0.5%. The index was up 12.9% in 2024, approximately half of the year’s average gain for the S&P 500 and Nasdaq Composite. The Nasdaq Composite eked out a positive return of 0.5% in December – trading at a new record above 20,000 mid-month – for a Q4 gain of 6.2%. The technology bellwether index continued its recovery from a 33% plunge in 2022, as investor frenzy for AI-related stocks led to a 43.4% rebound in 2023 and 28.6% in 2024.

The Russell 2000 – an index of U.S. small-cap stocks – tumbled 8.4% in December, paring most of the previous month’s 10.8% “Trump Trade” gain, which was triggered by optimism that the incoming U.S. administration’s focus on boosting domestic businesses would benefit smaller firms. The index was virtually flat in Q4, compared with the large-cap Russell 1000’s 2.4% advance in the quarter despite a 2.9% pullback in December. Large-caps outperformed small-caps by better than a 2:1 margin in 2024, with the Russell 1000’s 22.8% gain trouncing the Russell 2000’s 10.0% advance by nearly 13 percentage points, after beating it by more than nine percentage points in 2023.

International markets generally traded lower in Q4, as investors were rattled by Trump’s protectionist policies and tariff threats. While most European bourses declined in Q4, major markets like Germany and Italy posted double-digit gains in 2024; the U.K’s FTSE index rose 5.7% and France’s CAC-40 fell 2.2% over the year due to political uncertainty. As a result of this mixed performance, the Euro Stoxx 50 index gained 8.3% in 2024, trailing its U.S. counterparts by a wide margin.

In Asia, Japan’s Nikkei index gained 19.2% in 2024, after a 28% surge in the previous year that was its best performance since 1989, while Taiwan’s market rose 28.5% after gaining 27% in 2023. China’s Shanghai Composite posted its first annual gain since 2021 as it rose 12.7%, with almost all of those gains occurring in Q3 after the Chinese government unveiled a raft of stimulus measures. India’s Sensex tumbled 7.3% in Q4, paring its 2024 gain to 8.2%, while the 8.8% plunge in Brazil’s Bovespa over the quarter contributed to a 10.4% decline for the year.

The MSCI AC World Index, which captures large and mid-cap equity representation across most major developed and emerging markets, currently has a record 66.6% weight in the U.S. The index fell 1.7% in December for gains of 1.0% in Q4 and 18.4% in 2024.

Volatility may have been somewhat muted in equity markets but was quite elevated in fixed income markets last year, as bond yields gyrated in line with changing expectations for inflation and central bank rate cuts. At the beginning of 2024, investors were optimistic that the U.S. Federal Reserve would slash its benchmark interest rates as many as six times, for total easing of 150 basis points, over the course of the year. The Fed ended up cutting rates only thrice in 2024 for a total of 100 basis points, and only commenced its easing cycle in mid-September. The yield on the U.S. 10-year Treasury has increased 66 basis points over the past year to 4.66%, having gained more than a full percentage point since mid-September. The yield on 10-year Government of Canada bonds is up by a more sedate 12 basis points over the past year to 3.34%.

The adverse yield differential between Canadian and U.S. bonds, combined with the prospect of looming tariffs and broad US dollar strength, sent the Loonie tumbling 8.3% in 2024 to trade below 70 U.S. cents, matching its 2020 pandemic lows.

(Sources: FactSet, Bloomberg)

Figure 1: Magnificent 7 continues to dominate S&P 500 returns

Outlook & Portfolio Strategy

The Canadian economy grew markedly slower than the U.S. economy in 2024, and that growth divergence could widen in 2025. Canadian GDP shrank by 0.1% in November, the first monthly contraction in 2024, suggesting the economy grew at an 1.7% annualized pace in Q4, missing the Bank of Canada’s 2% forecast.

On December 11, 2024, the Bank of Canada lowered its benchmark overnight rate by 50 basis points to 3.25%, bringing its cumulative rate cuts to 175 basis points in just over half a year. This is the fastest pace of monetary easing among advanced economies and is indicative of the challenges facing the Canadian economy.

The Bank said its decision was based on inflation having returned to around 2%, and excess supply in the Canadian economy. While the Bank noted that the possibility of new tariffs imposed by the U.S. on Canadian exports has increased uncertainty about the economic outlook, it signaled that additional rate cuts would be at a more gradual pace. However, it would not surprise us to see more aggressive rate cuts by the Bank of Canada if the economy slows down further and/or tariffs on Canadian exports to the U.S. become a reality.

In the U.S., the Federal Reserve lowered the federal funds rate on December 18, 2024, by 25 basis points to a range of 4.25% – 4.50%. The third consecutive easing move by the Fed brings cumulative rate cuts since mid-September to 100 basis points. Fed officials reined in expectations for additional rate reductions in 2025, signaling two 25 basis-point cuts, compared with market expectations for three such trims.

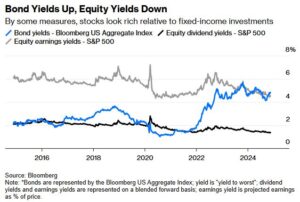

With yields on our fixed income portfolios well above 4%, and the prospect of potential capital appreciation if interest rates / yields decline, bonds look relatively attractive compared to U.S. stocks (Figure 2) on a valuation basis.

Earnings estimates for the S&P 500 (source: FactSet) are at $272.94 for 2025, an increase of almost 15% from an estimated $238.09 in 2024, with earnings growth forecast at 14% for 2026. Based on the S&P 500’s present level of 5,918, the index trades at a steep multiple of almost 25x 2024 EPS, and at just under 22x 2025 EPS. The earnings yield (which is the reciprocal of the P/E multiple) is currently at 4.0%, significantly below the 10-Treasury yield of 4.66%.

For the TSX Composite, earnings are forecast to increase about 12% to $1,640 in 2025 (from $1,468 in 2024), and by 10.5% in 2026. At its current level of 25,051, the index is trading at 17x 2024 EPS and at just over 15x 2025 EPS. Although that may appear cheap relative to the S&P 500’s valuations, the TSX Composite’s lower multiples should be viewed against the backdrop of Canada’s lower productivity and growth prospects, the cyclical nature of the TSX’s biggest sectors, and its relative underweight in the technology sector.

Rich stock valuations could make equities vulnerable to a correction if bond yields continue to rise (Figure 3). Our view is that volatility could resurface in equity markets this year, with a significant probability of a correction in excess of 10%.

Figure 2: Stocks appear richly valued compared to bonds

Figure 3: Higher bond yields = lower stock prices?

Based on these views, the Portfolio Management Team (PMT) has taken specific steps in recent months to mitigate downside risk as detailed below –

- In July 2024, we sold our individual stock holdings and allocated the proceeds to actively managed, diversified ETFs. This has eliminated single-stock volatility in client portfolios and enhanced upside capture.

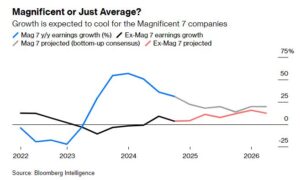

- Our concern about market concentration in the S&P 500 has been increasing, especially as growth rates for the “Magnificent 7” are slowing down while other sectors are catching up (Figure 4). While the top 10 stocks in the S&P 500 account for close to 40% of the index, they constitute a proportionately much smaller part of our portfolios. To further reduce our exposure to the biggest U.S. stocks, in November, we sold the S&P 500 Top 50 ETF (XLG) – a long-term holding – and ploughed the proceeds into a multi-factor, diversified U.S. ETF.

- Our portfolio rebalances in July and November occurred when indices were near record highs, giving us the opportunity to free up six months of cash for accounts with periodic withdrawals and precluding the need to sell equities in a near-term pullback.

- We are currently in the midst of making changes to the fixed income sleeve in client portfolios. Our objective is to fortify portfolios by boosting overall credit quality and eliminating securities where the risk-reward is no longer attractive.

Figure 4: Slowing growth for Mag 7

In 2024, our portfolios generated returns in line with their underlying benchmarks. Our Pension balanced growth portfolio returned 13.66% in 2024 (money-weighted return, net of fees), while the Pursuit growth portfolio generated a return of 16.20%. The Platinum Growth Fund, which is held in all models at Luft Financial, was a stellar performer in 2024 with a gain of 26.6%; it had returned 19% in 2023.

With our client portfolios now having greater exposure to a diversified basket of the biggest and best companies in the U.S. and Canada, we expect portfolio returns that are more closely aligned with the markets, as well as lower portfolio volatility through enhanced diversification. The PMT believes that client portfolios are well positioned for this stage of the economic cycle and will continue to manage client portfolios proactively with the objective of generating healthy risk-adjusted returns.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

April 2025 Portfolio Management Team Update

April 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth April 16, 2025 SUMMARY Market Review: Most global indices declined in March to cap a challenging quarter, before President Trump’s reciprocal tariffs announced on April 2 triggered the biggest slide in U.S. markets since the 2020 pandemic. The […]

Read more

March 2025 Portfolio Management Team Update

March 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth March 25, 2025 SUMMARY Market Review: North American indices fell in February on mounting concerns about the impact of a global trade war. The selloff intensified into March, triggering a 10% correction in the S&P500 that wiped out […]

Read more

February 2025 Portfolio Management Team Update

February 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth February 25, 2025 SUMMARY Market Review: Global equities began the year positively with solid returns in January, but volatility in recent weeks underscores the risks that lie ahead. The TSX rose 3.3% last month, trading at a record […]

Read more