Market Review

Global equities turned in a mixed performance in June, with declines by the TSX Composite and most European bourses offset by gains in U.S. and Asian markets. The MSCI AC World Index’s 2.4% advance last month enabled it to post a Q2 gain of 2.8%, after surging over 9% in each of the previous two quarters.

The TSX fell 1.8% for its second monthly decline since November. Last month’s drop was led by a 6.2% plunge in communication services, while the cyclical energy and materials groups also fell over 4.5%, offsetting a 6.8% surge in the technology sector. Overall, the index declined 1.3% in Q2, after a 5.8% gain in Q1.

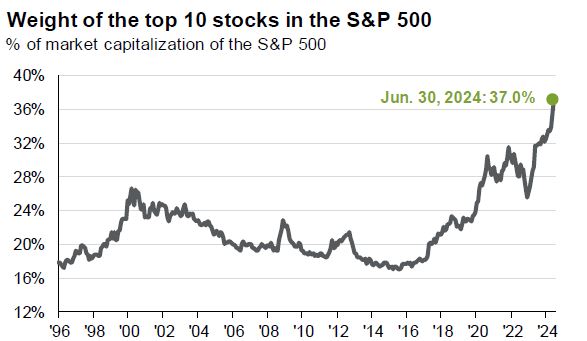

In the U.S., outsized contributions by a handful of technology mega-caps such as Nvidia and Microsoft enabled the S&P 500 to gain 3.5% in June and 3.9% in Q2, while the Nasdaq Composite surged 6.0% in the month and 8.3% in Q2. The Dow Jones Industrial Average rose 1.1% in June, for a Q2 decline of 1.7%.

With U.S. market performance continuing to be dominated by a few mega-caps, the performance differential between large-cap and small-cap stocks widened to more than 12 percentage points by end-Q2, as the Russell 1000 index gained 3.2% for the quarter, compared with a 3.6% decline for the Russell 2000 index.

In overseas markets, political turmoil in France led to a 6.4% drop in the CAC-40 index in June and an 8.9% plunge in Q2, with other European markets also affected by negative sentiment. The Taiwan index and India’s Sensex were among the best performers globally in June, rising to new highs with gains of 8.8% and 6.9% respectively in the month.

(Sources: FactSet, Bloomberg)

Outlook & Portfolio Strategy

Two significant market developments stood out in Q2 and after quarter-end:

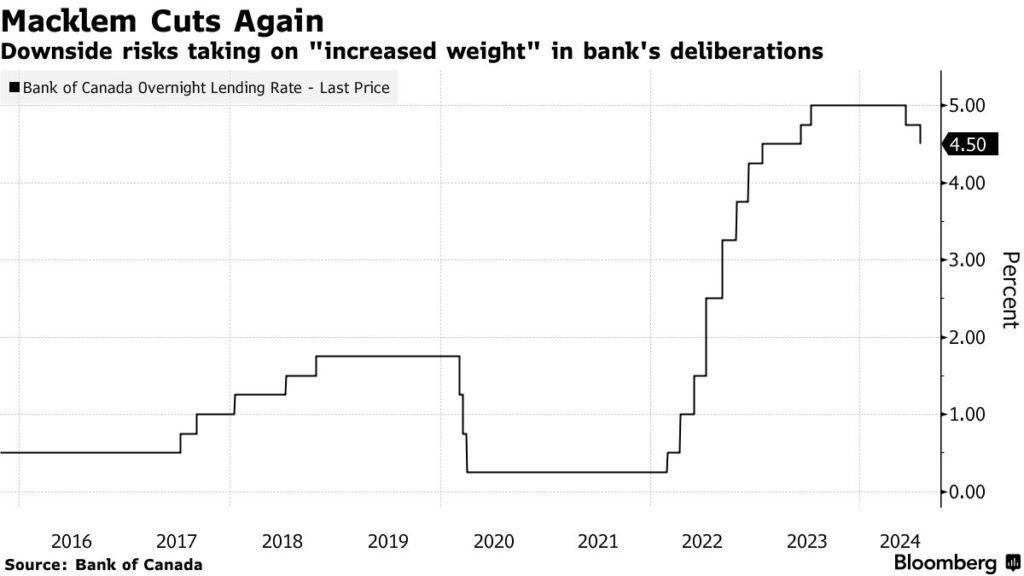

- Improved visibility on easing monetary policy by major central banks, after the Bank of Canada (BoC) became the first G-7 central bank to reduce its benchmark interest rate, doing so on June 5 and again on July 24 (Figure 1).

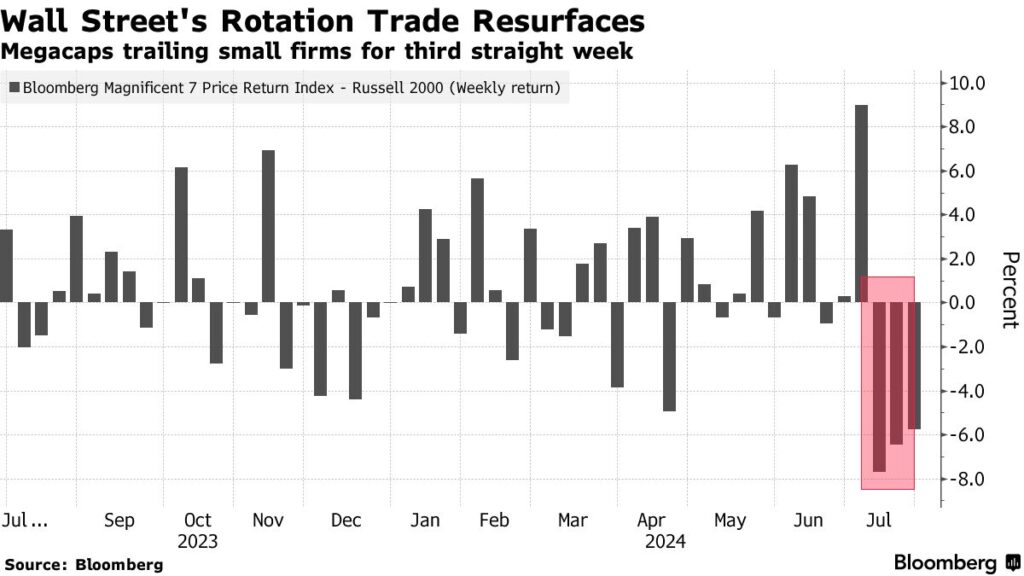

- Record market concentration in the S&P 500 (Figure 2), which has improved in recent weeks as decelerating inflation and optimism for a “soft landing” spurs rotation into other sectors.

On July 24, the Bank of Canada lowered the overnight rate by 25 basis points for the second consecutive meeting, as sluggish growth continued to cool inflation and attention turned to downside risks for the economy including overextended consumers and rising unemployment.

The BoC highlighted household spending that has been weaker than expected as a primary downside risk, with upcoming mortgage renewals posing a threat to consumption growth. The Bank also said that there are more signs of slack in the labour market as jobseekers take longer to find work. The unemployment rate in Canada is currently 6.4%, higher than its pre-pandemic level.

Despite these headwinds, the BoC continues to expect GDP growth to increase in the second half of 2024 and through 2025 – from 1.2% this year to above 2% in the next two years – reflecting stronger exports and a recovery in household spending and business investment as borrowing costs ease.

In the U.S., the upcoming Federal Reserve announcement on July 31 will be closely watched for any signals of imminent easing. While the Fed indicated at its June 12 meeting that it was in no hurry to ease borrowing costs – forecasting just one rate cut this year and more reductions in 2025 – market participants have recalibrated their expectations following recent data that showed U.S. inflation cooled in June to the slowest pace in 2021.

The inflation numbers on July 11 also spurred massive sector rotation as investors exited the “safety trade” of mega-cap technology into lagging sectors including small-cap shares. The Russell 2000 index of small-cap stocks outperformed the Nasdaq 100 by 5.8 percentage points on July 11, the biggest margin since November 2020. With the rotation trade playing out for three straight weeks (Figure 3) and with four of the “Magnificent Seven” reporting earnings in the last week of July, it remains to be seen whether this trade will endure in the second half of the year.

In Canada, interest-rate cuts have sparked renewed interest in rate-sensitive sectors including REITs, utilities, financials and telecoms, sending the TSX to a new intra-day record high of 22,996 on July 16. The TSX is outperforming the S&P 500 by more than four percentage points this month (as of July 29).

In mid-July, the Portfolio Management Team (PMT) made some significant changes to its large model portfolios, selling individual stock positions and deploying the proceeds in diversified, actively managed ETFs. These changes were made to reduce the growing divergence with underlying indices and benchmarks, since the value-oriented stocks that we owned had lagged their growth counterparts as interest rates climbed to multi-decade highs. As a result, our client portfolios now have greater exposure to a diversified basket of the biggest companies in the U.S. and Canada. The PMT is confident that these changes should provide better risk-adjusted returns over the long term.

For more information, please contact any member of the Luft Financial team.

Source: JP Morgan Asset Management

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.