June 2024 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth

June 25, 2024

Market Review

Global equities rebounded in May from the previous month’s decline that had interrupted five straight months of gains. While the TSX Composite reached an intra-day record high of 22,554.98 on May 21, continued enthusiasm for AI-related stocks took the S&P 500 and Nasdaq Composite to new highs during the month, with the Dow Jones Industrial Average (DJIA) topping 40,000 for the first time.

The TSX Composite ended the month with a 2.6% gain as most sectors participated in the rally. The Nasdaq Composite was among the best performers among major indexes with a 6.9% surge, while the S&P 500 gained 4.8% and the DJIA was up 2.3%.

The MSCI AC World Index advanced 3.5% to reverse April’s 2.9% decline. Most major European and Asian indexes also posted modest gains in May.

(Sources: FactSet, Bloomberg)

Outlook & Portfolio Strategy

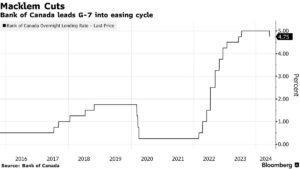

On June 5, 2024, the Bank of Canada (BoC) became the first G-7 central bank to commence an easing cycle (Figure 1), followed a day later by the European Central Bank.

The BoC lowered its benchmark overnight rate by 25 basis points to 4.75% in a move that was widely anticipated, marking the first rate cut in four years. The Bank said that with further evidence indicating underlying inflation is easing, monetary policy no longer needs to be as restrictive as it has been. BoC Governor Macklem said that more cuts are likely if inflation progress continues, but decisions will be taken “one meeting a at a time,” which implies that additional cuts will depend on economic data. In the U.S. the Federal Reserve signaled on June 12 that it was in no hurry to ease borrowing costs, as it forecast just one rate cut this year and more reductions in 2025.

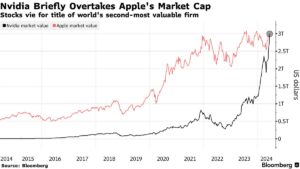

Investors continue to drive U.S. indices higher, with the S&P 500 trading briefly above 5,500 earlier this month, even as the broad decline in Treasury yields across the board suggests some uneasiness about the economic outlook. Another concern is the extent to which the U.S. market advance has become increasingly reliant on only a couple of stocks like Nvidia (Figure 2) and Microsoft. Nvidia single-handedly contributed more than one-third of the S&P 500’s year-to-date total return of 11.0% as of May 31.

As noted last month, the Portfolio Management Team (PMT) has made some significant changes to its model portfolios, after recently completing an in-depth review. The PMT will implement these model changes in July and expects better risk-adjusted returns for client portfolios as a result.

Figure 1: Bank of Canada’s first rate cut since 2020

Figure 2: Nvidia’s brief reign as #1

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.