MACROSCOPE: Risk mitigation should help our portfolios stay healthy despite the coronavirus

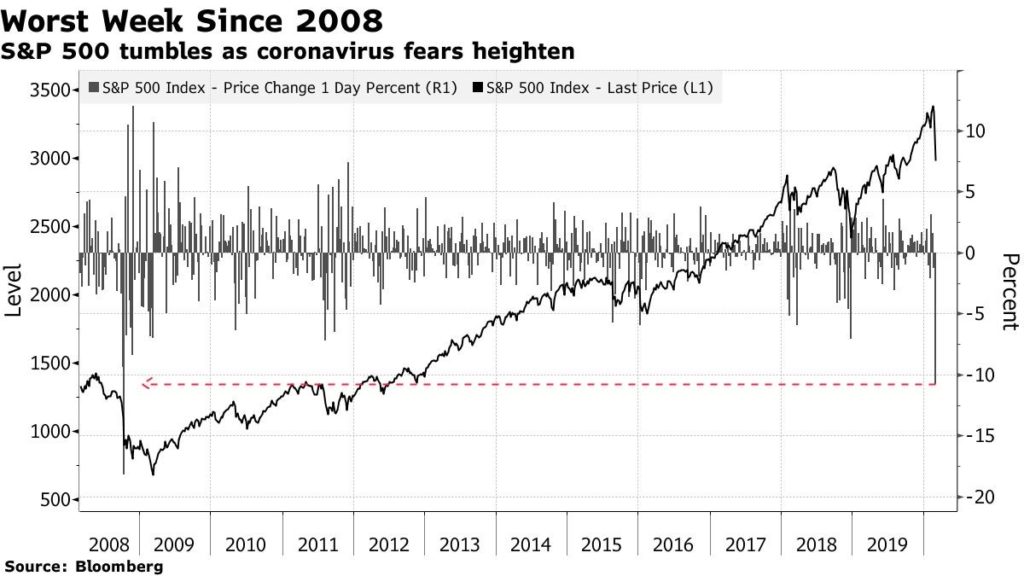

This week’s market correction is almost unparalleled in its ferocity (Figure 1), with major US indices plunging by double-digits in a matter of days. Incredible as it may seem, North American indices were at record highs just about a week ago. As of yesterday’s close, however, the S&P 500, DJIA and Nasdaq were more than 12% below their recent highs, putting them in official correction territory. The TSX is 7% below its February 20 record high, but that’s only because a technical glitch halted trading yesterday afternoon (talk about bad timing!) and not due to a remarkable spell of outperformance.

What caused the turnaround in sentiment from last week’s complacency? There has been a cascade of negative news centering around the coronavirus this week that suggests it may be spreading globally and could have a significant economic impact. Market bellwethers like Microsoft and Apple have already reduced their profit estimates for the quarter because of supply-chain disruptions related to the virus. These technology giants have been at the forefront of the record US stock rally, and their lowered outlook does not bode well for other companies.

Reflecting this dismal reality, major Wall Street firms have commenced slashing profit estimates for the S&P 500. Strategists at Goldman Sachs yesterday reduced their baseline earnings-per-share (EPS) estimates for the S&P 500 by 5.2% to $165 for this year – which would represent zero growth – and cut their 2021 forecast by 4.4% to $175. In contrast, analysts were forecasting about 10% annual EPS growth for 2020 and 2021, based on estimates compiled by FactSet at the beginning of this year.

Like many others, we have watched with an increasing sense of disquiet as stock markets powered their way to new highs seemingly every week. Rather than succumb to the temptation of chasing the high-fliers, we have taken steps over the past three months to dial down portfolio risk even further, such as the following:

- In the third week of November, we took advantage of the market rally to exit positions in underperforming securities that could be vulnerable in a market downturn, thereby improving overall portfolio quality, and ploughed the proceeds into higher-quality holdings, such as an ETF of the Top 50 US companies.

- In the second week of February, with stock markets at or near record highs, we took profits in some of our most profitable positions and deployed the proceeds into fixed income and other less-volatile securities.

- Earlier this week, we took some profits in a few stocks belonging to defensive sectors that had held up well (such as gold miners and utilities) and used the proceeds to add to positions in stocks that were trading at compelling valuations.

While our focus on risk mitigation – a critical component of investing for the long haul – may lead to our portfolios trailing their benchmarks in strong bull markets, this approach ensures adequate downside protection during volatile times like the present. As our clients may be aware, the risk mitigation strategies we employ in our investment portfolios include:

- Being adequately diversified by investing in asset classes that have an inverse or low correlation with stocks, such as long-term government bonds, as well as alternative investments like mortgages and hedge funds.

- Investing primarily in blue-chip, financially strong companies that offer stable returns over the long term with lower risk than the broad market.

- Holding part of the portfolios in US dollar-denominated assets, since the Canadian dollar usually weakens versus the USD during times of market stress.

- Ensuring that our portfolios have adequate amounts invested in near-cash instruments (high-interest accounts and short-term bonds), so that we can capitalize on investment opportunities as they arise.

Our portfolios have held up well during previous periods of market stress, and we expect them to perform similarly during the current bout of heightened volatility. Our game-plan is to judiciously add to positions if the market selloff continues, as it is unearthing quality investment opportunities for the first time in many months. While there is a palpable sense of virus-induced panic in the markets, amid the drumbeat of bad news, we remind investors about Warren Buffett’s comments in 2009 in the aftermath of the financial crisis – “A climate of fear is their (investors’) best friend. Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance.”

Figure 1: S&P 500’s biggest weekly plunge since the financial crisis

________________________________________________________________________________

This information has been prepared by Robert Luft and Elvis Picardo, who are Portfolio Managers, and Aaron Arnold, who is an Investment Advisor, for HollisWealth® and does not necessarily reflect the opinion of HollisWealth®. HollisWealth® is a division of Industrial Alliance Securities Inc., a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Robert Luft, Elvis Picardo and Aaron Arnold can open accounts only in the provinces in which they are registered. For more information about HollisWealth, please consult the official website at www.holliswealth.com. Luft Financial is a personal trade name of Robert Luft.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

April 2025 Portfolio Management Team Update

April 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth April 16, 2025 SUMMARY Market Review: Most global indices declined in March to cap a challenging quarter, before President Trump’s reciprocal tariffs announced on April 2 triggered the biggest slide in U.S. markets since the 2020 pandemic. The […]

Read more

March 2025 Portfolio Management Team Update

March 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth March 25, 2025 SUMMARY Market Review: North American indices fell in February on mounting concerns about the impact of a global trade war. The selloff intensified into March, triggering a 10% correction in the S&P500 that wiped out […]

Read more

February 2025 Portfolio Management Team Update

February 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth February 25, 2025 SUMMARY Market Review: Global equities began the year positively with solid returns in January, but volatility in recent weeks underscores the risks that lie ahead. The TSX rose 3.3% last month, trading at a record […]

Read more