March 2024 Portfolio Management Team Update

March 2024 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth

March 20, 2024

Market Review

Global equities advanced for the fourth successive month in February, as growing confidence in a “soft landing” for most major economies took the MSCI All-Country World Index to a new high.

The TSX Composite gained 1.63% in February, with gains in the energy, financials and consumer sectors offsetting declines in the materials group, and interest rate-sensitive communication services and utilities. U.S. equity indices closed at record highs on the last day of the month after an inflation gauge’s reading was in line with estimates. The S&P 500 advanced 5.17%, posting its 14th record high on February 29. The Dow Jones Industrial Average was up 2.22% for the month, while the Nasdaq Composite surged 6.12% as technology stocks were yet again the biggest contributors to index gains.

Overseas markets also reported strong gains in February, led by Asian heavyweights Japan and China. Japan’s Nikkei-225 reached new highs in the month as it gained 7.94%, fuelled by robust earnings and investor-friendly measures. China’s CSI-300 index staged a massive reversal to go from the world’s worst-performing equity index to among its best performers. The index soared 9.35% in February on optimism that the government’s support measures will enable an economic recovery; Hong Kong’s Hang Seng also rose 6.63%. Most major European bourses posted solid gains, with the Euro Stoxx 50 index up 4.93% for the month.

(Sources: FactSet, Bloomberg)

Economic Outlook

Although investors’ expectations about interest-rate cuts this year have been reset to more realistic levels, market moves in the short-term continue to be dictated primarily by comments from Federal Reserve officials about the rate outlook, and inflation data.

On March 20, the S&P 500 closed at a new high above 5,200 after the Federal Reserve maintained that three rate cuts are still likely in 2024, beginning in June, with Fed chair Powell unconcerned about a recent uptick in inflation. While the Fed left its benchmark federal funds rate unchanged in the 5.25% – 5.50% range for the fifth straight meeting, Powell said that rate cuts would not be appropriate until officials have more confidence that inflation is moving sustainably towards its 2% target.

In Canada, the March 20 release of the minutes of the Bank of Canada’s March 6 meeting – at which the benchmark rate was held at 5% for the fifth straight meeting – revealed that officials expected rate cuts to commence this year if the economy evolved in line with their forecasts. (Note that in January, the Bank of Canada had forecast economic growth would continue to remain weak in the first quarter of 2024 and pick up gradually from mid-year).

Bank officials were concerned, however, that a potential housing rebound in spring could complicate the inflation picture by pushing up the cost of shelter – a key component of inflation – and delaying the return of CPI inflation to the 2% target. On March 19, Statistics Canada reported that Canada’s inflation rate unexpectedly decelerated to 2.8% in February, the second successive month of sub-3% inflation since early 2021. The inflation data adds to evidence that the Bank of Canada may soon be able to consider rate cuts as disinflation sets in, with traders boosting odds of a rate cut in June to 75%.

Portfolio Strategy

Overall, the economic environment remains supportive for further gains in equities, with the prospects of recession receding, corporate profits growing at a healthy clip, and inflation trending lower.

As of March 20, the TSX Composite was up 5.19% YTD, trailing the S&P 500’s 9.53% advance by over 400 basis points. While the TSX has some catching up to do in relation to its U.S. counterparts, on a positive note, the index closed above the 22,000 level on March 20 for the first time in almost two years and is currently within striking distance of its record high of 22,213 set in April 2022.

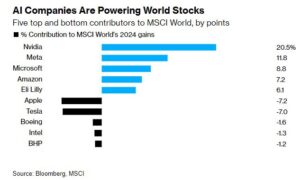

Although market breadth is improving as more stocks and sectors participate in the rally, the U.S. advance is still being driven by a few dominant stocks such as Nvidia, which had contributed more than 20% of the gains for the MSCI World Index for developed markets as of February 22 (Figure 1). Further improvement in market breadth is necessary for the rally to continue.

The Portfolio Management Team (PMT) rebalanced all client portfolios in the last week of February, marginally increasing equity allocation and swapping out a commodities-focused ETF for a Dynamic Funds covered options ETF that generates a yield of over 6%. The PMT has also deployed all recent contributions made to registered and other accounts, to maximize participation in the market rally.

Figure 1: AI-related companies are the biggest contributors to global market gains

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.

This information has been prepared by Luft Financial. Opinions expressed in this article are those of Luft Financial only and do not necessarily reflect those of iA Private Wealth. Furthermore, this does not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors.

How do we elevate your wealth?

It begins with understanding your needs and creating a comprehensive and tailored financial plan to help reduce tax, manage risk and grow your portfolio over the long term. Learn more about how we help you achieve financial security and peace of mind.

News & commentary

March 2025 Portfolio Management Team Update

March 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth March 25, 2025 SUMMARY Market Review: North American indices fell in February on mounting concerns about the impact of a global trade war. The selloff intensified into March, triggering a 10% correction in the S&P500 that wiped out […]

Read more

February 2025 Portfolio Management Team Update

February 2025 Portfolio Management Team Update By Elvis Picardo, CFA®, CIM, Senior Portfolio Manager, iA Private Wealth February 25, 2025 SUMMARY Market Review: Global equities began the year positively with solid returns in January, but volatility in recent weeks underscores the risks that lie ahead. The TSX rose 3.3% last month, trading at a record […]

Read more

2024 IAPW Tax Document Distribution Dates

2024 IAPW Tax Document Distribution Dates There are different mailing dates for different account types. Please click on the link below to view the expected delivery for both mail and online tax slips and reports. 2024 Important Year-End Information – Tax Document Distribution Dates

Read more