Market Review

Global equities briefly paused their rally in October ahead of the U.S. Presidential elections, before the “Trump Trade” drove U.S. indices to new highs this month.

The TSX eked out a 0.65% gain in October, its fourth straight monthly advance, taking its year-to-date gains to 15.3%. Last month’s gains were led by energy and materials producers, while consumer sectors, real estate and communication services lagged.

In the U.S., the S&P 500 fell 1.0% for its first decline since April, for a YTD gain of 19.6%. The Dow Jones Industrial Average also had its first drop in six months with a 1.3% pullback, while the Nasdaq Composite retreated 0.5%.

The MSCI AC World Index also had its winning streak interrupted in October as it fell 1.2%. Most European and Asian indexes traded lower last month, with India’s Sensex among the biggest decliners with a 5.8% drop.

(Sources: FactSet, Bloomberg)

Economic Highlights

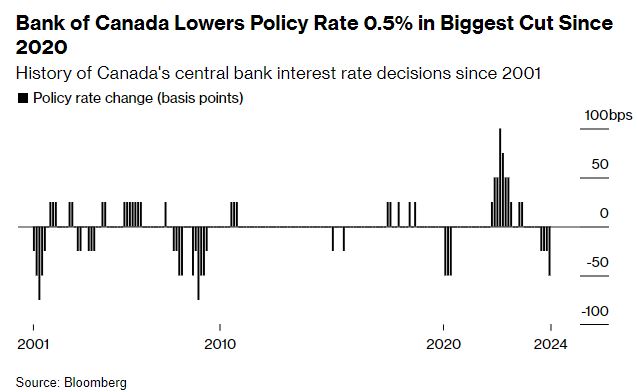

On October 23, the Bank of Canada lowered its benchmark overnight rate by 50 basis points to 3.75%, the biggest reduction in borrowing costs since the early phase of the pandemic in March 2020 (Figure 1). The Bank’s next rate decision – the last one for this year – is on December 11, with some economists already projecting another 50-bps cut.

In its accompanying Monetary Policy Report, the Bank said that consumer price inflation (CPI) in Canada had fallen and is now around 2%, reflecting lower energy prices and weaker underlying inflationary pressures. Regarding economic growth, the Bank noted that Q2 growth was slightly stronger than expected but Q3 was weaker. It expects growth to pick up gradually, averaging 2¼% over 2025 and 2026.

In the U.S., the Federal Reserve lowered the federal funds rate by 25 basis points on November 7 to a range of 4.5% – 4.75%, the second straight cut after a half-point reduction in September. Fed chairman Powell reiterated that the Fed is not in a hurry to cut borrowing costs and noted that it is too early to know the timing or impact of any potential changes in fiscal policy.

Outlook & Portfolio Strategy

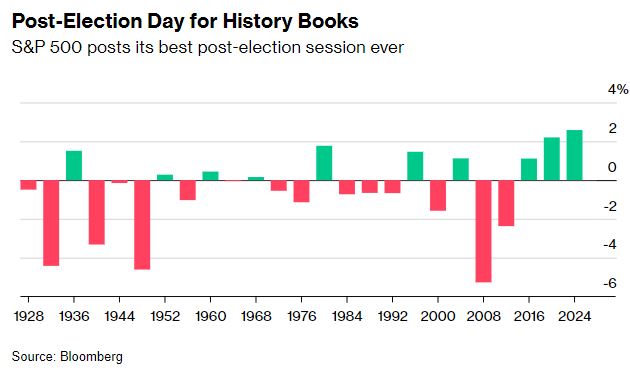

The S&P 500 notched its best post-election gain in history (Figure 2), surging 2.5% on November 6 on optimism that the incoming administration led by President-elect Trump will usher in pro-growth policies that will boost American companies. The S&P 500 is up 4.6% for the month (as of November 22), having traded above the 6,000 level for the first time in mid-month, with the Dow Jones up 6.1% and the Nasdaq Composite up 5.0%. The TSX Composite has not lagged either, surging 5.3% so far in November. (Source: FactSet).

The period after the U.S. Thanksgiving until year-end tends to be one of the seasonally strongest times for North American equities. But given the strength of the rally so far (TSX +21.4% YTD, S&P 500 +25.2%), it may be reasonable (and prudent) to expect some volatility in December, as investors book profits and position themselves for what could be a challenging year.

The Portfolio Management Team (PMT) rebalanced all client portfolios in the third week of November, taking advantage of indices’ all-time highs to free up six months of cash for accounts with periodic withdrawals. A notable change made in the portfolio rebalance was that we sold the S&P 500 Top 50 ETF (XLG) – a long-term holding – and ploughed the proceeds into a multi-factor, diversified U.S. ETF. The rationale for this change was to reduce our exposure to the biggest U.S. stocks, as the equity rally continues to broaden. In our opinion, client portfolios are well-positioned for 2025, with portfolio changes made since July enabling participation in most of the markets’ upside while mitigating downside risk.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.