September 2023 Portfolio Management Team Update

By Elvis Picardo, CFA®, CIM, Portfolio Manager, iA Private Wealth

September 20, 2023

Market Review

Global equities retreated in August, after posting their best performance in the first seven months of a year since 2009, as uncertainty about the future trajectory of interest rates – fueled by stubbornly high inflation – coupled with softer economic data stopped the global rally in its tracks.

The TSX Composite slipped 1.6% last month, with four sectors falling 4% or more – consumer discretionary, utilities, financials, and materials. The financials group was weighed down by a decline in Canadian banks after they reported lower earnings, while rising bond yields took a toll on utility shares. The energy sector was the best performer in the index, as crude oil prices continued to advance.

In the U.S., the S&P 500 fell 1.8% in August after 10 of its 11 groups retreated, led by a 6.7% tumble in utilities, with the energy sector the only one to advance marginally. The Nasdaq Composite pared part of its 37% surge (to July 31) with a 2.2% decline, while the Dow Jones Industrial Average fell 2.4%. Most European and Asian equity indices also pulled back last month after adding to their strong first-half performance with additional gains in July. Hong Kong’s Hang Seng index was the worst performer globally last month with an 8.5% slide (Data Source: FactSet).

Economic Update

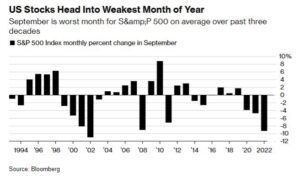

Market action over the past eight weeks has yet again justified the reputation of August and September as the most volatile months in the year. Over the past three decades, the S&P 500 has recorded its worst monthly performance on average in September (Figure 1), followed by August.

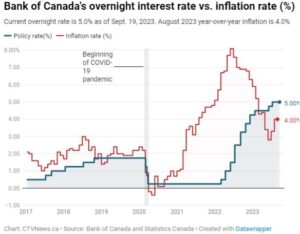

Investors have been rattled by persistently high inflation even as incoming data suggests the economy may be slowing down. Earlier this week, Canada’s CPI number for August showed headline inflation at 4% – the second successive monthly increase – led by higher food and gasoline prices. The report spurred speculation that the Bank of Canada may be forced to boost its benchmark rate at its October 25 meeting, after holding it steady at 5% earlier this month (Figure 2).

But with signs of a looming slowdown, the Bank of Canada and the U.S. Federal Reserve are caught between a rock and a hard place, with little choice but to maintain the delicate balance at which interest rates are high enough to dampen inflation without tipping the economy into a deep recession. Earlier this month, reports showed that the Canadian economy unexpectedly contracted at a 0.2% annualized pace in the second quarter, compared with the Bank of Canada’s forecast for a 1.5% expansion, and a significant deceleration from a 2.6% growth pace in Q1.

There is little doubt that the steep pace of interest rate hikes over the past 18 months is causing tremendous stress on Canadian consumers’ balance sheets. In its latest earnings report, Royal Bank of Canada (RBC) disclosed that as of July, 43% of its Canadian residential mortgages had an amortization period of more than 25 years, compared with 40% a year ago and just 26% in January 2022. 23% of RBC’s Canadian mortgages have amortization periods greater than 35 years. Over this timeframe, RBC’s posted rate on variable mortgages has ballooned to over 7%, from about 2.5% before the Bank of Canada began tightening monetary policy. At Toronto-Dominion Bank (TD), 48% of its Canadian mortgages were amortized for over 25 years, compared with 35% a year ago. Delinquency rates for Canadian consumers who have missed two or more credit card payments are also increasing and are back to the pandemic levels of June 2020.

Over in the U.S., the optimism for a “soft landing” that took the S&P 500 to within 5% of its record high by end-July has been significantly dispelled, as the Federal Reserve (the “Fed”) remains resolute in its battle against inflation. On September 20, the Fed signaled that interest rates would be higher for longer even as it held its target range for the federal funds rate unchanged at 5.25% – 5.50%. Two-year Treasury yields hit their highest level since 2006, and 10-year government bond yields have spiked over the past month by 19 basis points in Canada (to 3.91%) and 16 basis points in the U.S. (to 4.43%).

Figure 1: September Selloffs – this month is typically S&P 500’s worst in past three decades

Figure 2: Will BoC’s September pause prove to be temporary?

Our Strategy

In the first week of August, the Portfolio Management Team (PMT) undertook a full rebalance of all client portfolios to capitalize on the market rally and raise cash balances for periodic withdrawal plans. The rebalance resulted in trimming strong gains from securities such as the Platinum Growth Fund and allocating it to lagging positions that we believe have long-term upside. Concurrently, we also rationalized some of our smaller model portfolios to improve their degree of diversification.

As Canadian investors, the performance of our portfolios is heavily influenced by that of the TSX Composite index. The TSX has been virtually flat over the past two years (closing level on September 21, 2021: 20,244.29; September 20, 2023: 20,214.70), with the only return arising from its 3% annualized dividend. Over this period, the S&P 500 is up by a scant 1.1%, while the Nasdaq Composite is down 8.7%. But despite this state of stasis, returns over the past 10 years (to Sept. 20, 2023) have been stellar, especially for the U.S. indices. While the TSX has a total return (including dividends) of 7.9% annually over the past decade, the S&P 500 and Nasdaq Composite have generated annual returns of 12.0% and 14.7% respectively.

These returns are a reminder that investors should focus on the long term at times like these, when balanced portfolios have only recovered part of the drubbing they received in 2022 (the worst year for balanced portfolios since 1937). With the eye-popping returns south of the border (S&P 500 +14.7% YTD, Nasdaq +28.7%) attributable to a handful of technology stocks, we believe there is tremendous opportunity in other sectors like U.S. health care and utilities. The relatively high rates from cash deposits and GICs notwithstanding, balanced portfolios are the place to be (see “5 reasons to consider a Balanced Portfolio over a 5% GIC” below).

We expect current market volatility to continue into the fourth quarter, with seasonal strength likely towards year-end. Heading into 2023, our asset allocation was tilted towards the defensive on the premise of a possible recession (which has not yet materialized). Our focus in the months ahead will be on optimizing asset allocation and potentially boosting growth exposure across our model portfolios.

Please contact any member of the PMT if you have any questions or concerns regarding your accounts.

This information has been prepared by Elvis Picardo, who is a Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Manager can open accounts only in the provinces in which they are registered.